Question: please answer 7-8 with work! The firm is considering a new project that it considers to be a little riskier than its current operations. Thus,

please answer 7-8 with work!

please answer 7-8 with work!

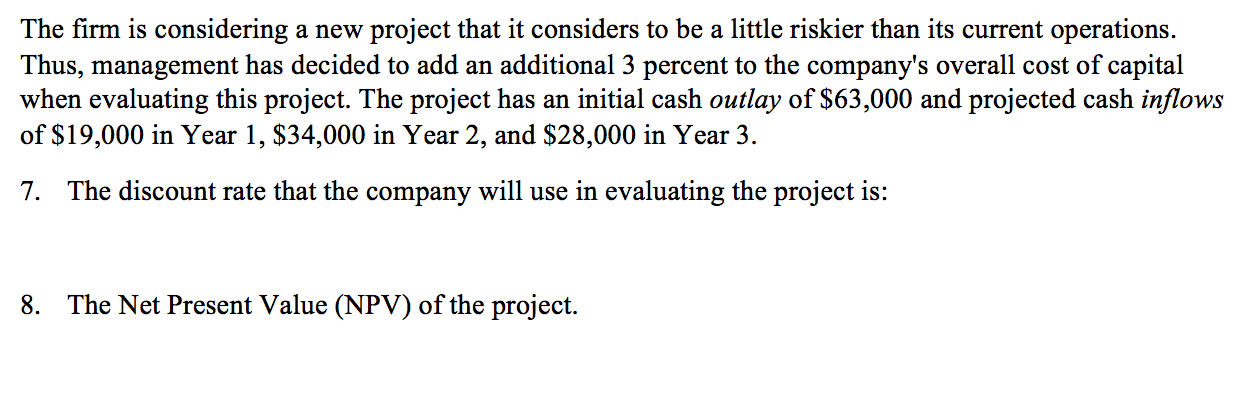

The firm is considering a new project that it considers to be a little riskier than its current operations. Thus, management has decided to add an additional 3 percent to the company's overall cost of capital when evaluating this project. The project has an initial cash outlay of $63,000 and projected cash inflows of $19,000 in Year 1, $34,000 in Year 2, and $28,000 in Year 3. 7. The discount rate that the company will use in evaluating the project is: 8. The Net Present Value (NPV) of the project. The firm is considering a new project that it considers to be a little riskier than its current operations. Thus, management has decided to add an additional 3 percent to the company's overall cost of capital when evaluating this project. The project has an initial cash outlay of $63,000 and projected cash inflows of $19,000 in Year 1, $34,000 in Year 2, and $28,000 in Year 3. 7. The discount rate that the company will use in evaluating the project is: 8. The Net Present Value (NPV) of the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts