Question: Please answer a) b) and c) of this problem and show all work. Thank you! Tesla is considering a major expansion of its product line

Please answer a) b) and c) of this problem and show all work. Thank you!

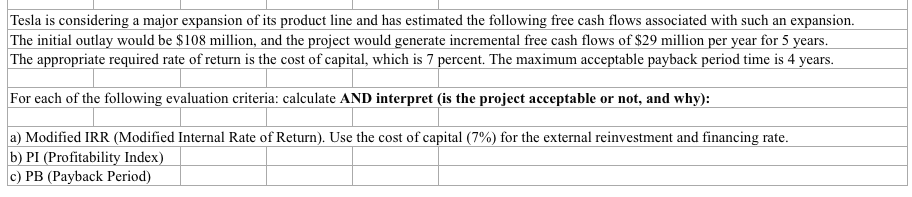

Tesla is considering a major expansion of its product line and has estimated the following free cash flows associated with such an expansion. The initial outlay would be $108 million, and the project would generate incremental free cash flows of $29 million per year for 5 years. The appropriate required rate of return is the cost of capital, which is 7 percent. The maximum acceptable payback period time is 4 years. For each of the following evaluation criteria: calculate AND interpret (is the project acceptable or not, and why): a) Modified IRR (Modified Internal Rate of Return). Use the cost of capital (7%) for the external reinvestment and financing rate. b) PI (Profitability Index) c) PB (Payback Period)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts