Question: Please answer A B and C Problems 1. You work at the currency desk at Barings Bank in London. As the middleman in a deal

Please answer A B and C

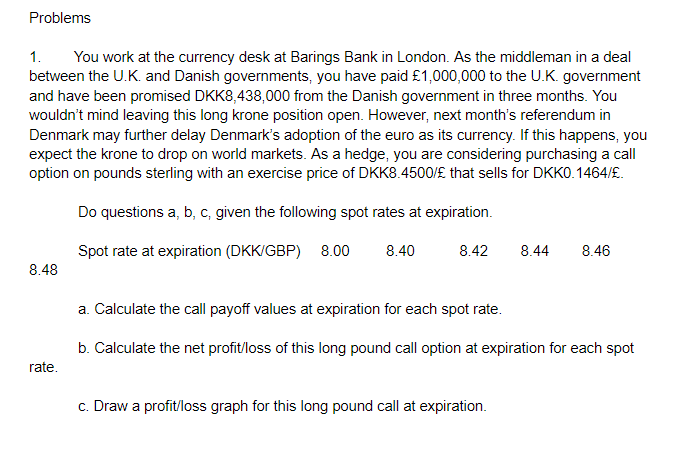

Problems 1. You work at the currency desk at Barings Bank in London. As the middleman in a deal between the U.K. and Danish governments, you have paid 1,000,000 to the U.K. government and have been promised DKK8,438,000 from the Danish government in three months. You wouldn't mind leaving this long krone position open. However, next month's referendum in Denmark may further delay Denmark's adoption of the euro as its currency. If this happens, you expect the krone to drop on world markets. As a hedge, you are considering purchasing a call option on pounds sterling with an exercise price of DKK8.4500/ that sells for DKKO. 1464/. Do questions a, b, c, given the following spot rates at expiration. Spot rate at expiration (DKK GBP) 8.00 8.40 8.42 8.44 8.46 8.48 a Calculate the call payoff values at expiration for each spot rate. b. Calculate the net profit/loss of this long pound call option at expiration for each spot rate. c. Draw a profit/loss graph for this long pound call at expiration. Problems 1. You work at the currency desk at Barings Bank in London. As the middleman in a deal between the U.K. and Danish governments, you have paid 1,000,000 to the U.K. government and have been promised DKK8,438,000 from the Danish government in three months. You wouldn't mind leaving this long krone position open. However, next month's referendum in Denmark may further delay Denmark's adoption of the euro as its currency. If this happens, you expect the krone to drop on world markets. As a hedge, you are considering purchasing a call option on pounds sterling with an exercise price of DKK8.4500/ that sells for DKKO. 1464/. Do questions a, b, c, given the following spot rates at expiration. Spot rate at expiration (DKK GBP) 8.00 8.40 8.42 8.44 8.46 8.48 a Calculate the call payoff values at expiration for each spot rate. b. Calculate the net profit/loss of this long pound call option at expiration for each spot rate. c. Draw a profit/loss graph for this long pound call at expiration

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts