Question: PLEASE ANSWER ACCORDINGLY TO MARKS QUESTION 1 You are a financial controller for BMB Refinery Sdn Bhd. You are very sure that your company requires

PLEASE ANSWER ACCORDINGLY TO MARKS

PLEASE ANSWER ACCORDINGLY TO MARKS

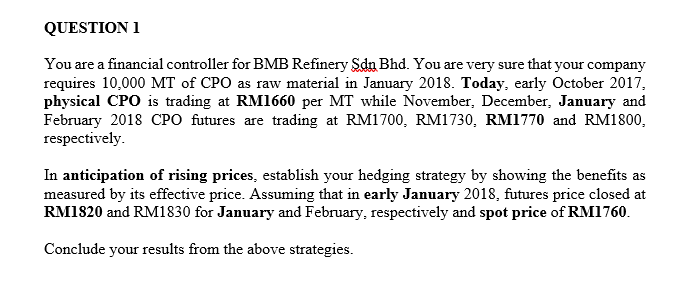

QUESTION 1 You are a financial controller for BMB Refinery Sdn Bhd. You are very sure that your company requires 10,000 MT of CPO as raw material in January 2018. Today, early October 2017, physical CPO is trading at RM1660 per MT while November, December, January and February 2018 CPO futures are trading at RM1700, RM1730. RM1770 and RM1800, respectively. In anticipation of rising prices, establish your hedging strategy by showing the benefits as measured by its effective price. Assuming that in early January 2018, futures price closed at RM1820 and RM1830 for January and February, respectively and spot price of RM1760. Conclude your results from the above strategies

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts