Question: QUESTION 2 You are a financial controller for BMB Refinery Sdn. Bhd. You are very sure that your company requires 5,000 MT of CPO as

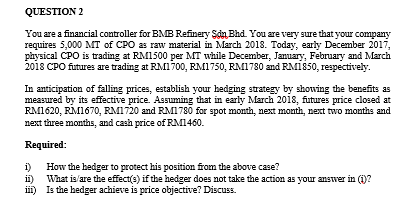

QUESTION 2 You are a financial controller for BMB Refinery Sdn. Bhd. You are very sure that your company requires 5,000 MT of CPO as raw material in March 2018. Today, early December 2017, physical CPO is trading at RM1500 per MT while December, January, February and March 2018 CPO futures are trading at RM1700, RM1750, RM1780 and RM1850, respectively In anticipation of falling prices, establish your bedging strategy by showing the benefits as measured by its effective price. Assuming that in early March 2018, futures price closed at RM1620, RM1670, RM1720 and RM1780 for spot month, next month, next two months and next three months, and cash price of RM1460. Required: i) How the hedger to protect his position from the above case? ii) What is are the effect(s) if the hedger does not take the action as your answer in ()2 iil) Is the hedger achieve is price objective? Discuss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts