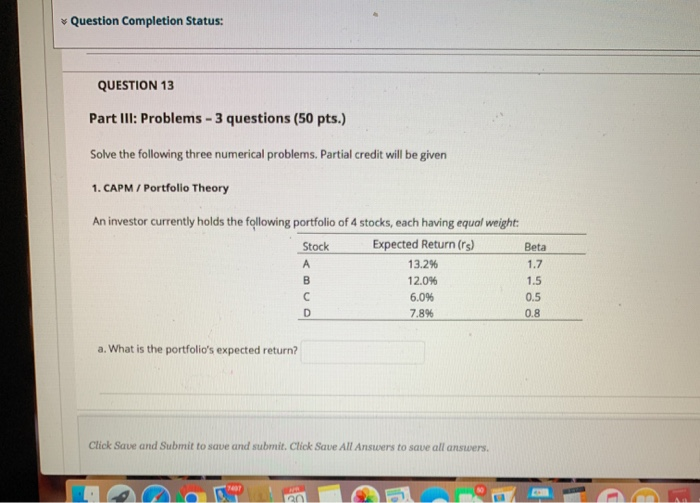

Question: Please answer a-f a. What is the portfolio's expected return? b. What is the portfolio's beta risk? c. Is the portfolio more or less risky

Question Completion Status: QUESTION 13 Part III: Problems - 3 questions (50 pts.) Solve the following three numerical problems. Partial credit will be given 1. CAPM / Portfolio Theory An investor currently holds the following portfolio of 4 stocks, each having equal weight: Stock Expected Return (rs) Beta 13.2% 12.0% 6.0% 7.8% a. What is the portfolio's expected return? Click Save and Submit to save and submit. Click Save All Answers to save all answers. 90cm

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts