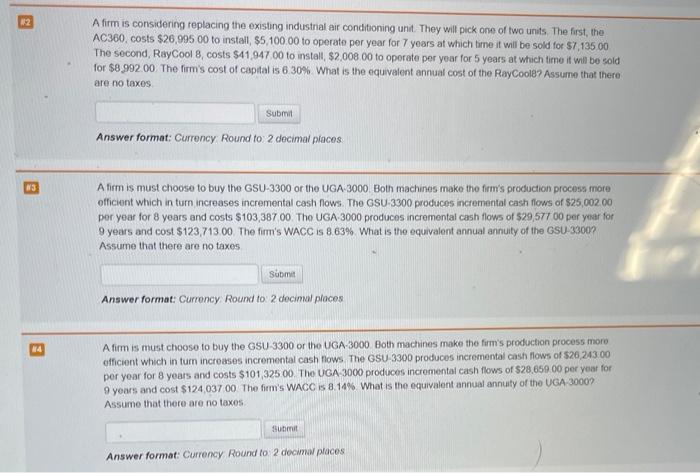

Question: Please answer all! 12 A firm is considering replacing the existing industrial air conditioning unit. They will pick one of two units. The first, the

12 A firm is considering replacing the existing industrial air conditioning unit. They will pick one of two units. The first, the AC360, costs $26,995 00 to install $5,100.00 to operate per year for 7 years at which time it will be sold for $7,135 00 The second, RayCool 8, costs $41,947 00 to instalt, $2.008.00 to operate per year for 5 years at which time it will be sold for $8.992.00 The firm's cost of capital is 630% What is the equivalent annual cost of the RayCool87 Assume that there are no taxes Submit Answer format: Currency Round to 2 decimal places 83 Afirmis must choose to buy the GSU-3300 or the UGA 3000 Both machines make the firm's production process more officient which in turn increases incremental cash flows. The GSU 3300 produces incremental cash flows of $25,002.00 per year for 8 years and costs $103,387 00 Tho UGA-3000 produces incremental cash flows of 529 577 00 per year for years and cost $123,713.00 The firm's WACC IS 8 63% What is tho equivalent annual annuity of the GSU 33007 Assume that there are no taxes Submit Answer format: Currency Round to 2 decimal places 4 Afirm is must choose to buy the GSU 3300 or the UGA-3000 Both machines make the firm's production process more officient which in turn increases incremental cash flows The GSU 3300 produces incremental cash flows of $26 243.00 por yoar for 8 years and costs $101,32500 The UGA 3000 produces incremental cash flows of $28,650.00 per year for 9 years and cost $124.037 00 The firm's WACC is 8.14% What is the equivalent annual annuity of the UGA 30009 Assume that there are no taxes Submit Answer format: Currency Round to 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts