Question: WILL GIVE THUMBS UP FOR CORRECT ANSWER. THANK YOU A firm is considering replacing the existing industrial air conditioning unit. They will pick one of

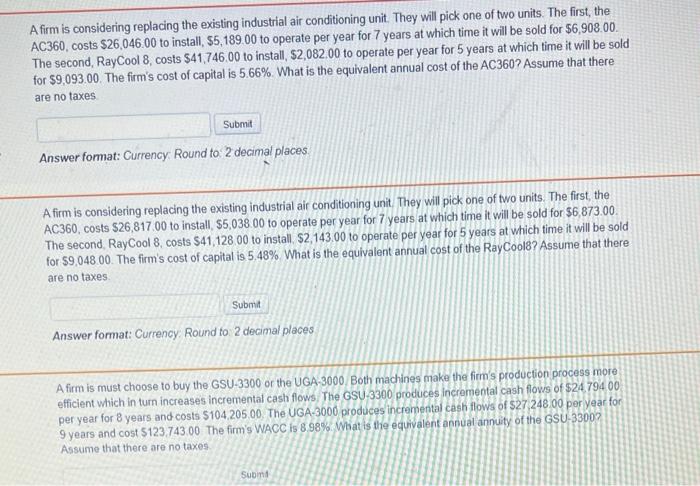

A firm is considering replacing the existing industrial air conditioning unit. They will pick one of two units. The first, the AC360, costs $26,046.00 to install, $5,189.00 to operate per year for 7 years at which time it will be sold for $6,908.00. The second, RayCool 8, costs $41,746.00 to install, $2,082.00 to operate per year for 5 years at which time it will be sold for $9.093.00. The firm's cost of capital is 5.66%. What is the equivalent annual cost of the AC360? Assume that there are no taxes Answer format: Currency: Round to 2 decimal places. A firm is considering replacing the existing industrial air conditioning unit. They will pick one of two units. The first, the AC360, costs $26,817.00 to install, $5,038.00 to operate per year for 7 years at which time it will be sold for $6,873.00. The second, RayCool 8 , costs $41,128,00 to install, $2,143,00 to operate per year for 5 years at which time it will be sold for $9,04800. The firm's cost of capital is 5.48%. What is the equivalent annual cost of the Raycool8? Assume that there are no taxes. Answer format: Currency. Round to 2 decimal places A firm is must choose to buy the GSU-3300 or the UGA-3000. Both machines make the firm's production process more efficient which in turn increases incremental cash flows. The GSU-3300 produces incremental cash flows of $24.79400 per year for 8 years and costs $104,205.00. The UGA-3000 produces incremental cash flows of $27.248.00 por year for 9 years and cost $123.743.00 The firm's WACC is 8.98%. What is the equivalent annual annuity of the GSU-3300? Assume that there are no taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts