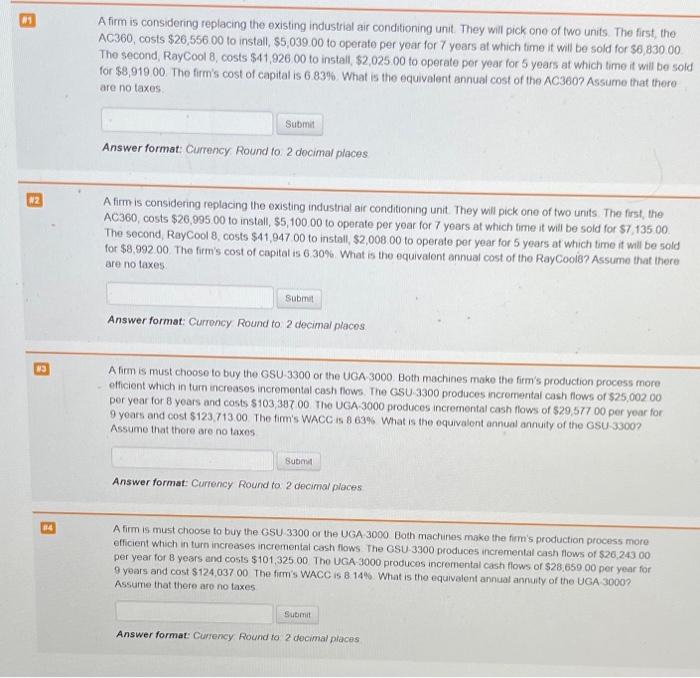

Question: Please answer all! E A firm is considering replacing the existing industrial air conditioning unit. They will pick one of two units. The first, the

E A firm is considering replacing the existing industrial air conditioning unit. They will pick one of two units. The first, the AC360, costs $26,556 00 to install $5,039.00 to operate per year for 7 years at which time it will be sold for 56,83000 The second, RayCool 8, costs $11,926 00 to install, $2,025.00 to operate per year for 5 years at which time it will be sold for $8,919 00. The firm's cost of capitalis 683% What is the equivalent annual cost of the AC3607 Assume that there are no taxes Submit Answer format: Currency Round to 2 decimal places N2 A firm is considering replacing the existing industrial air conditioning unit. They will pick one of two units. The first, the AC360, costs $26,995.00 to install, 55,100.00 to operate per yoar for 7 years at which time it will be sold for $7,135 00 The second, RayCool 8, costs $41,947 00 to install, $2,008.00 to operato per year for 5 years at which time it will be sold for $8.992 00 The firm's cost of capital is 6 30% What is the equivalent annual cost of the RayCoolb? Assume that there are no taxes Submit Answer format: Currency Round to 2 decimal places B A firm is must choose to buy the GSU 3300 or the UGA 3000 Both machines make the firm's production process more officient which in turn increases incremental cash flows. The GSU 3300 produces incremental cash flows of $25,002 00 per year for 8 years and costs $103,387 00 Tho UGA 3000 produces incremental cash flows of $29,577 00 per year for 9 years and cost $123.713.00 The firm's WACC is 8 63% What is the equivalent annual annuity of the GSU 33007 Assume that there are no taxes Submit Answer format: Currency Round to 2 decimal places 34 Afirmis must choose to buy the GSU 3300 or the UGA 3000 Both machines make the firm's production process more efficient which in turn increases incremental cash flows The GSU-3300 produces incremental cash flows of $26,243 00 per year for 8 years and costs $101.325.00 Tho UGA 3000 produces incremental cash flows of $28,650.00 per year for 9 years and cost $124,037 00 The firm's WACC IS 8 14% What is the equivalent annual annuity of the UGA 3000? Assume that there are no taxes Submit Answer format: Currency Round to 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts