Question: PLEASE ANSWER ALL 3 MULTIPLE CHOICE QUESTIONS XYZ Co. stock sells for $42 and just a paid a dividend of 54. Dividends are expected to

PLEASE ANSWER ALL 3 MULTIPLE CHOICE QUESTIONS

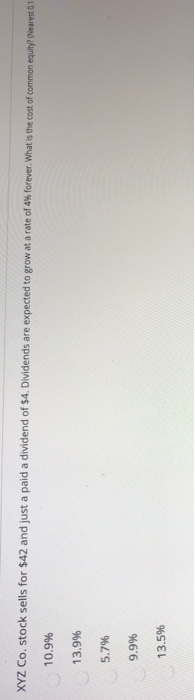

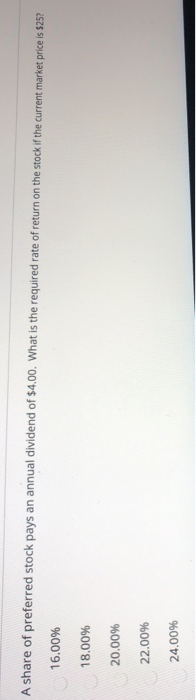

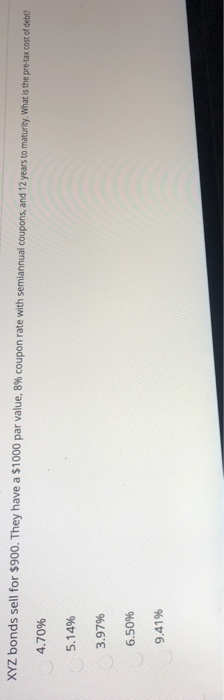

PLEASE ANSWER ALL 3 MULTIPLE CHOICE QUESTIONSXYZ Co. stock sells for $42 and just a paid a dividend of 54. Dividends are expected to grow at a rate of 4% forever. What is the cost of common equity? (Nearest 0.1 10.9% 13.996 5.7% 9.996 13.5% A share of preferred stock pays an annual dividend of $4.00. What is the required rate of return on the stock if the current market price is $25? 16.00% 18.00% 20.00% 22.00% 24.00% XYZ bonds sell for $900. They have a $1000 par value, 8% coupon rate with semiannual coupons, and 12 years to maturity. What is the pre-tax cost of debt? 4.70% 5.14% 3.97% 6.50% 9.41%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock