Question: please answer all 4 multiple choice questions A Co. issues $1,000 par value, 4.5% annual coupon bonds, with 15 years to maturity. The company sells

please answer all 4 multiple choice questions

please answer all 4 multiple choice questions

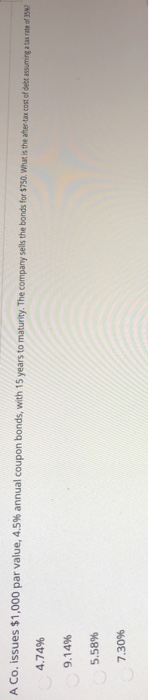

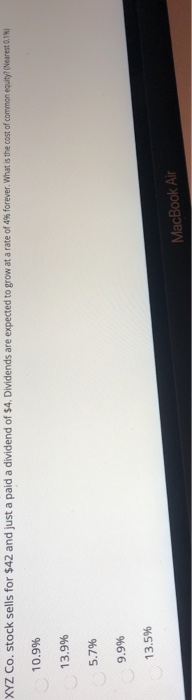

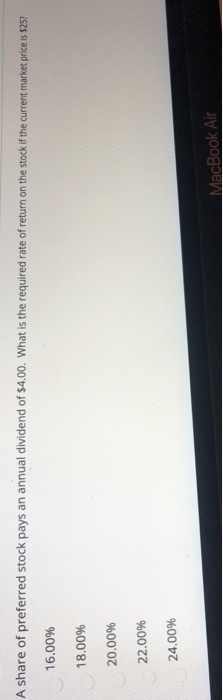

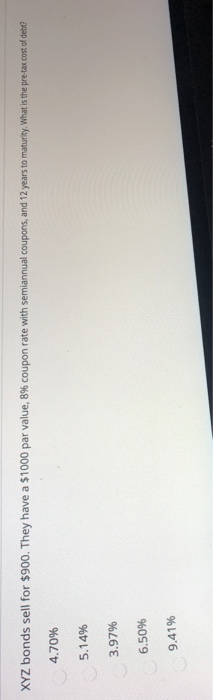

A Co. issues $1,000 par value, 4.5% annual coupon bonds, with 15 years to maturity. The company sells the bonds for $750. What is the afer tax cost of debt assuming a tax rate of 1542 4.74% 9.14% 5.58% 7.30% XYZ Co. stock sells for $42 and just a paid a dividend of $4. Dividends are expected to grow at a rate of 4% forever. What is the cost of common equity? (Nearest 0.14 10.9% 13.9% 5.7% 9.9% 13.5% MacBook Air A share of preferred stock pays an annual dividend of $4.00. What is the required rate of return on the stock if the current market price is $25? 16.00% 18.00% 20.00% 22.00% 24.00% MacBook Air XYZ bonds sell for $900. They have a $1000 par value, 8% coupon rate with semiannual coupons, and 12 years to maturity. What is the pre-tax cost of debt? 4.70% 5.14% 3.97% 6.50% 9.41%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts