Question: Please answer all 3 questions! 19. A pension plan has promised to pay out $25 million per year over the next 15 years to its

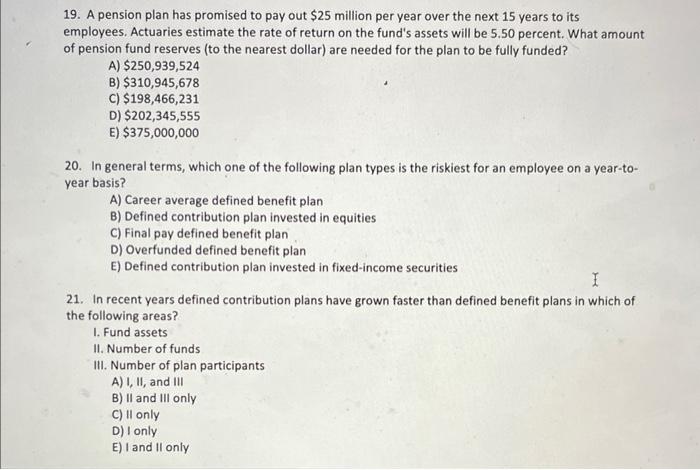

19. A pension plan has promised to pay out $25 million per year over the next 15 years to its employees. Actuaries estimate the rate of return on the fund's assets will be 5.50 percent. What amount of pension fund reserves (to the nearest dollar) are needed for the plan to be fully funded? A) $250,939,524 B) $310,945,678 C) $198,466,231 D) $202,345,555 E) $375,000,000 20. In general terms, which one of the following plan types is the riskiest for an employee on a year-toyear basis? A) Career average defined benefit plan B) Defined contribution plan invested in equities C) Final pay defined benefit plan D) Overfunded defined benefit plan E) Defined contribution plan invested in fixed-income securities 21. In recent years defined contribution plans have grown faster than defined benefit plans in which of the following areas? I. Fund assets II. Number of funds III. Number of plan participants A) I, II, and IIII B) II and III only C) II only D) I only E) I and II only

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts