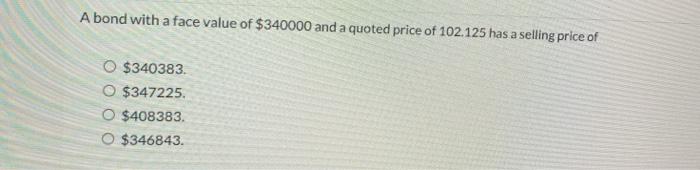

Question: please answer all 3 thank you!! 14. 15. 16. A bond with a face value of $340000 and a quoted price of 102.125 has a

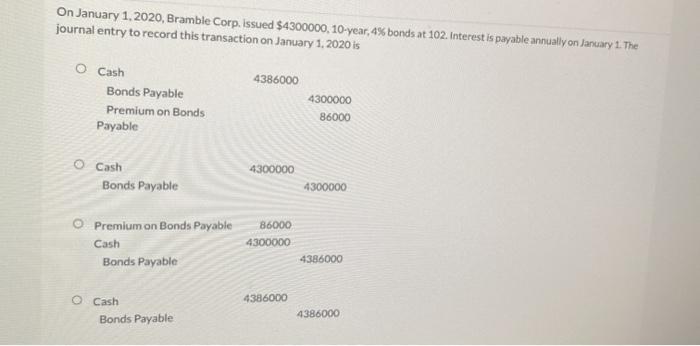

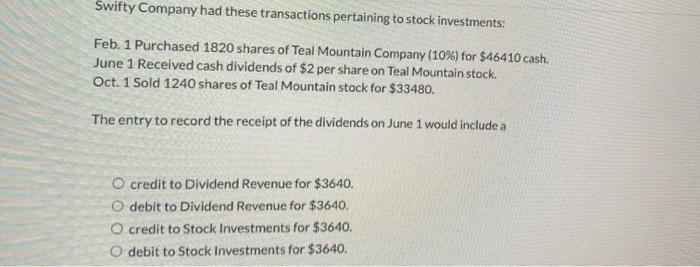

A bond with a face value of $340000 and a quoted price of 102.125 has a selling price of O $340383 O $347225 O $408383 O $346843. On January 1, 2020, Bramble Corp. issued $4300000, 10-year,4% bonds at 102. Interest is payable annually on January 1. The journal entry to record this transaction on January 1, 2020 is 4386000 O Cash Bonds Payable Premium on Bonds Payable 4300000 86000 4300000 Cash Bonds Payable 4300000 O Premium on Bonds Payable Cash Bonds Payable 86000 4300000 4386000 4386000 Cash Bonds Payable 4386000 Swifty Company had these transactions pertaining to stock investments: Feb. 1 Purchased 1820 shares of Teal Mountain Company (10%) for $46410 cash. June 1 Received cash dividends of $2 per share on Teal Mountain stock. Oct. 1 Sold 1240 shares of Teal Mountain stock for $33480. The entry to record the receipt of the dividends on June 1 would include a O credit to Dividend Revenue for $3640. O debit to Dividend Revenue for $3640. O credit to Stock Investments for $3640. O debit to Stock Investments for $3640

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts