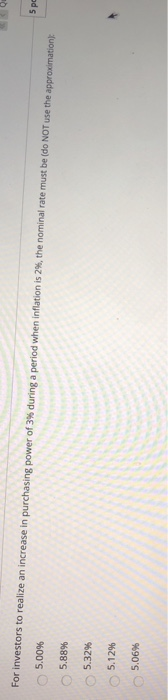

Question: please answer all 4 multiple choice quesrtions 5.00% spo For investors to realize an increase in purchasing power of 3% during a period when inflation

please answer all 4 multiple choice quesrtions

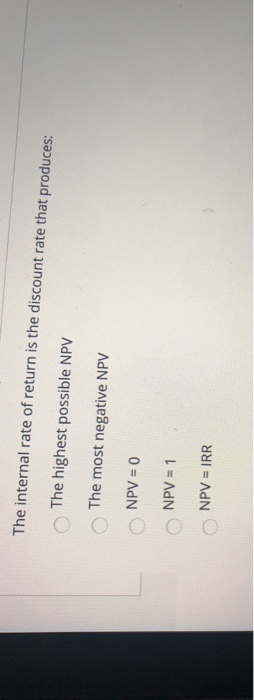

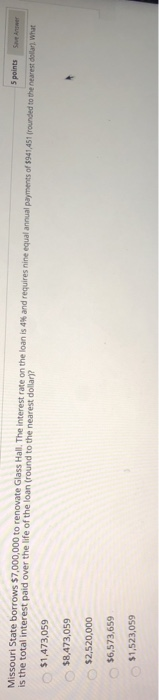

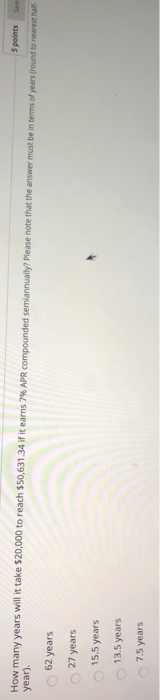

please answer all 4 multiple choice quesrtions5.00% spo For investors to realize an increase in purchasing power of 3% during a period when inflation is 2%, the nominal rate must be (do NOT use the approximation: 5.88% 5.32% 5.12% 5.06% The internal rate of return is the discount rate that produces: The highest possible NPV The most negative NPV NPV = 0 NPV = 1 NPV = IRR 5 points Missouri State borrows $7,000,000 to renovate Glass Hall. The interest rate on the loan is 4% and requires nine equal annual payments of 5941,451 rounded to the nearest dollar. What is the total interest paid over the life of the loan (round to the nearest dollar? $1,473,059 $8.473,059 $2,520,000 $6,573,659 $1,523,059 5 points Save How many years will it take $20,000 to reach $50,631.34 if it earns 7% APR compounded semiannually? Please note that the answer must be in terms of years fround to nearest half year). 62 years 27 years 15.5 years 13.5 years 7.5 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts