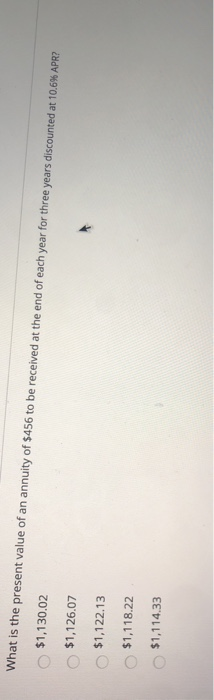

Question: please answer all 4 multiple choice questions $1,130.02 What is the present value of an annuity of $456 to be received at the end of

please answer all 4 multiple choice questions

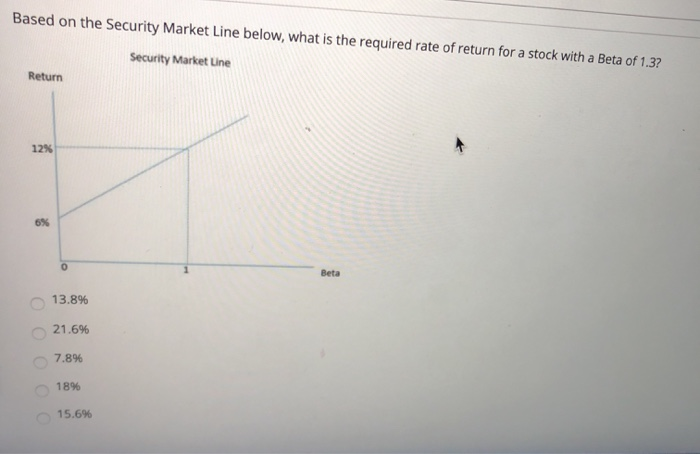

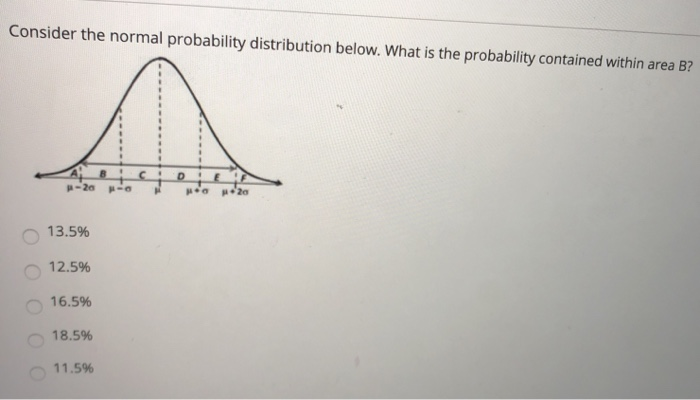

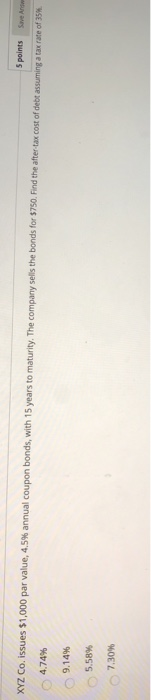

please answer all 4 multiple choice questions$1,130.02 What is the present value of an annuity of $456 to be received at the end of each year for three years discounted at 10.6% APR? $1,126.07 $1,122,13 $1,118.22 31,114.33 Based on the Security Market Line below, what is the required rate of return for a stock with a Beta of 1.3? Security Market Line Return 12% 6% O Beta 13.8% 21.6% 7.896 18% 15.6% Consider the normal probability distribution below. What is the probability contained within area B? -20 20 13.5% 12.5% 16.5% 18.5% 11.5% 5 points Save XYZ Co. issues $1,000 par value, 4,5% annual coupon bonds, with 15 years to maturity. The company sells the bonds for $750. Find the after tax cost of debt assuming a tax rate of 35% 4.74% 9.14% 5.58% 7.30%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts