Question: please answer all 4 multiple choice questions (chegg policy allows 4 mc questions) What is the yield to maturity of a bond with a par

please answer all 4 multiple choice questions (chegg policy allows 4 mc questions)

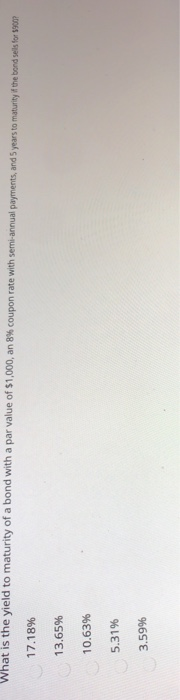

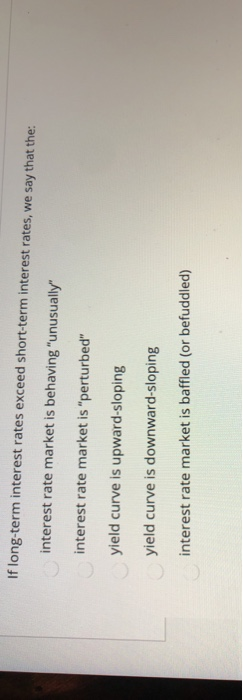

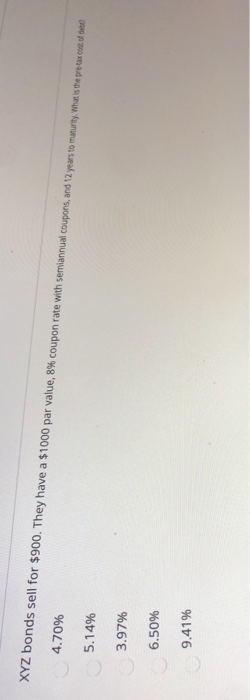

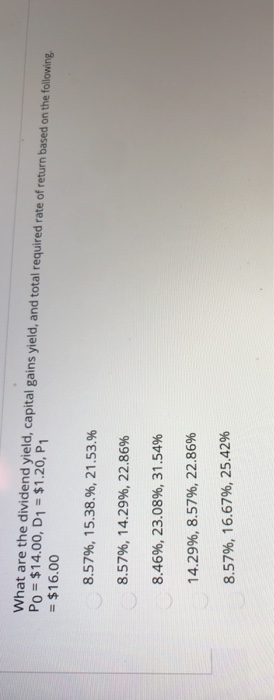

please answer all 4 multiple choice questions (chegg policy allows 4 mc questions)What is the yield to maturity of a bond with a par value of $1,000, an 8% coupon rate with semi-annual payments, and 5 years to maturity in the bond sells for 1907 17.18% 13.65% 10.63% 5.31% 3.59% If long-term interest rates exceed short-term interest rates, we say that the: interest rate market is behaving "unusually" interest rate market is "perturbed" yield curve is upward-sloping yield curve is downward-sloping interest rate market is baffled (or befuddled) 4.70% 5.14% XYZ bonds sell for $900. They have a $1000 par value, 8% coupon rate with semiannual coupons, and 12 years to maturity. What is the pre tax cost of it 3.97% 6.50% 9.41% Po = $14.00, D1 = $1.20, P1 What are the dividend yield, capital gains yield, and total required rate of return based on the following, = $16.00 8.57%, 15.38.%, 21.53.% 8.57%, 14.29%, 22.86% 8.46%, 23.08%, 31.54% 14.29%, 8.57%, 22.86% 8.57%, 16.67%, 25.42%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts