Question: please answer all 4 question chegg allows upto 4 questions to be answer. please i need the questions answered because the assigment is do by

please answer all 4 question chegg allows upto 4 questions to be answer.

please i need the questions answered because the assigment is do by 11:30 pm if you couldnt answer them could you just answer 8 and 9

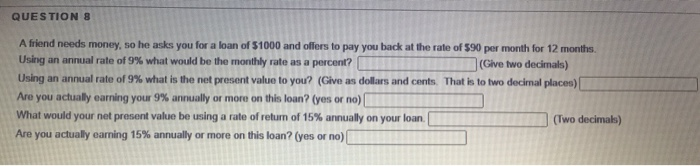

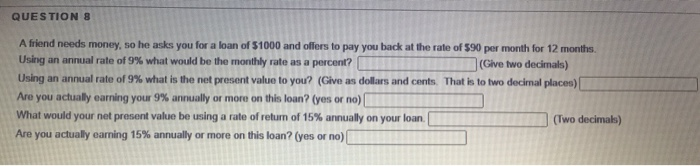

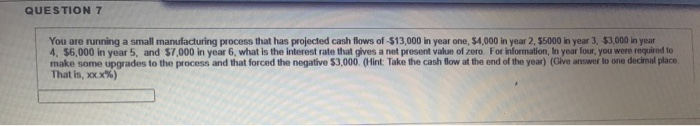

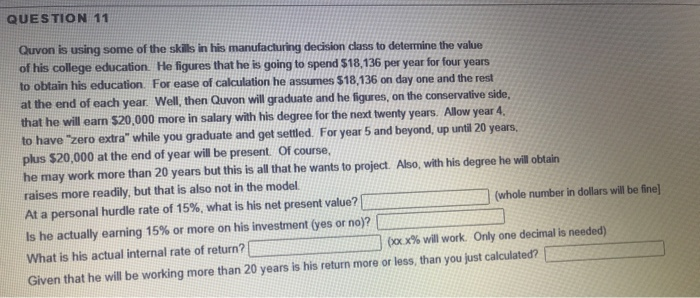

QUESTIONS A friend needs money, so he asks you for a loan of $1000 and offers to pay you back at the rate of 590 per month for 12 months. Using an annual rate of 9% what would be the monthly rate as a percent? (Give two decimals) Using an annual rate of 9% what is the net present value to you? (Give as dollars and cents. That is to two decimal places) Are you actually earning your 9% annually or more on this loan? (yes or no) What would your net present value be using a rate of return of 15% annually on your loan. (Two decimals) Are you actually earning 15% annually or more on this loan? (yes or no) QUESTION 7 You are running a small manufacturing process that has projected cash flows of $13,000 in year one, 54,000 in year 2, 55000 in year 3.53,000 in year 4, 56,000 in year 5, and $7,000 in year 6, what is the interest rate that gives a net present value of zero. For information, In year four, you were required to make some upgrades to the process and that forced the negative 53,000. (Hint: Take the cash flow at the end of the year) (Give answer to one decimal place That is, xcx%) QUESTIONS Your manufacturing location is considering whether to invest in a new machine The machine will cost $40,000 up front The predicted profit from this machine per year will vary with production. You have estimated the machine to reduce the cost per piece procensed by S125 per piece. Your production volumes are predicted to be 10,000 for year one, 12,000 for year 2, 14,000 for year 3, 15,000 for year 4 and 12,000 for your 5 Maintenance must be subtracted from your savings. Maintenance for years through 3 will be $2,000 but year 4 will be $3,000 and year 5 will be $1,000 No production will be done in year 6, and the machine will be sold for $4,000 Your company is a very profitable company and forces a burchlorate of 20% What is the predicted profit at the end of year one? (Give no decimals) What is the predicted profit at the end of year five? (Give no decimals) What is the net present value at the 20% hurdle rate? (Give two decimals) Does this project pass the hurdle rate barried? (yes or no) If the scrap value in year 6 would have been $3,000 rather than $4,000 would this project pass the hurdle rate? (yes or no) QUESTION 11 Quvon is using some of the skills in his manufacturing decision class to determine the value of his college education. He figures that he is going to spend $18,136 per year for four years to obtain his education. For ease of calculation he assumes $18,136 on day one and the rest at the end of each year. Wellthen Quvon will graduate and he figures, on the conservative side, that he will earn $20,000 more in salary with his degree for the next twenty years. Allow year 4. to have "zero extra" while you graduate and get settled. For year 5 and beyond, up until 20 years, plus $20,000 at the end of year will be present. Of course, he may work more than 20 years but this is all that he wants to project. Also, with his degree he will obtain raises more readily, but that is also not in the model. At a personal hurdle rate of 15%, what is his net present value? (whole number in dollars will be fine] Is he actually earning 15% or more on his investment (yes or no)? What is his actual internal rate of return? (xx.x% will work. Only one decimal is needed) Given that he will be working more than 20 years is his return more or less than you just calculated

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock