Question: Please answer all 4 white boxes or I will down vote, thank you! Your investment bankers price your IPO at $14.92 per share for 9.9

Please answer all 4 white boxes or I will down vote, thank you!

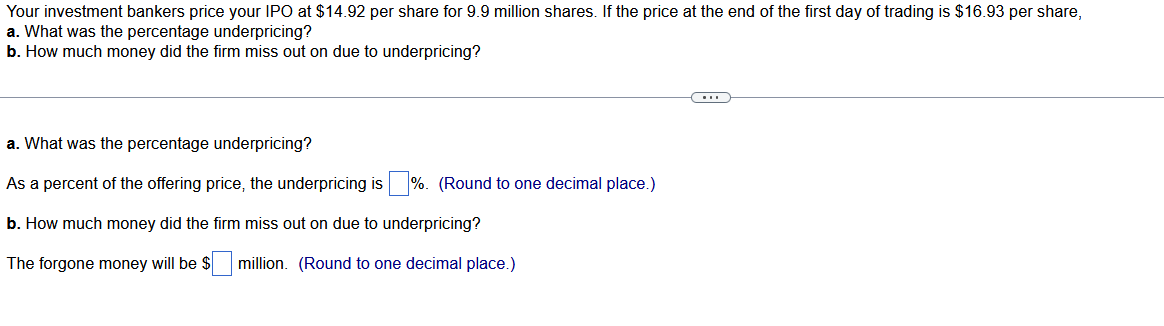

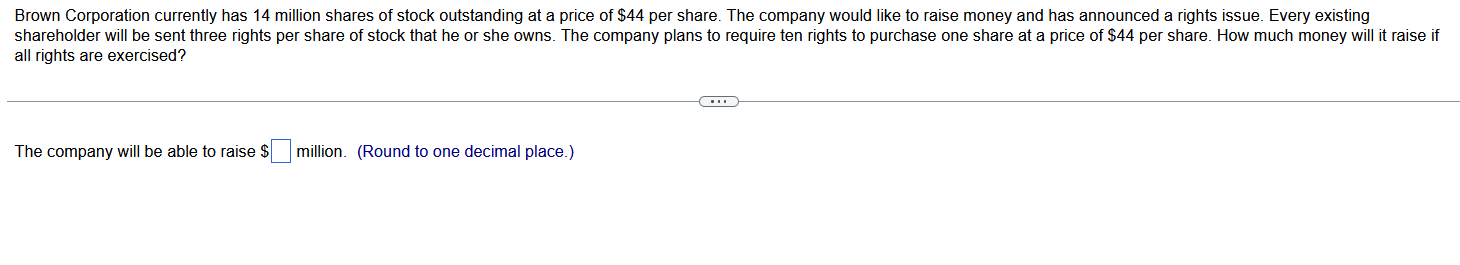

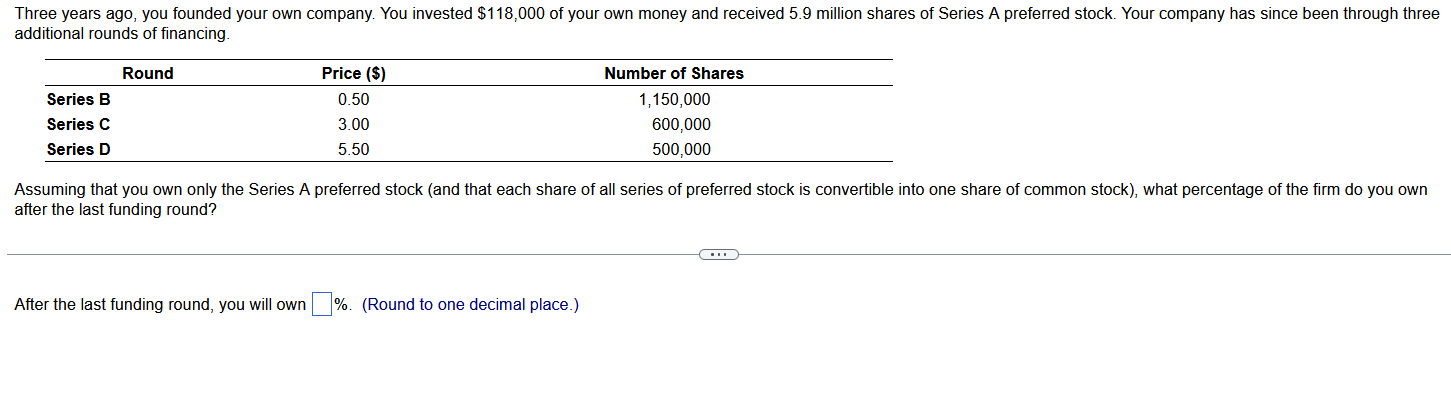

Your investment bankers price your IPO at $14.92 per share for 9.9 million shares. If the price at the end of the first day of trading is $16.93 per share, a. What was the percentage underpricing? b. How much money did the firm miss out on due to underpricing? a. What was the percentage underpricing? As a percent of the offering price, the underpricing is %. (Round to one decimal place.) b. How much money did the firm miss out on due to underpricing? The forgone money will be $ million. (Round to one decimal place.) Brown Corporation currently has 14 million shares of stock outstanding at a price of $44 per share. The company would like to raise money and has announced a rights issue. Every existing shareholder will be sent three rights per share of stock that he or she owns. The company plans to require ten rights to purchase one share at a price of $44 per share. How much money will it raise if all rights are exercised? The company will be able to raise $ million. (Round to one decimal place.) Assuming that you own only the Series A preferred stock (and that each share of all series of preferred stock is convertible into one share of common stock), what percentage of the firm do you own after the last funding round? After the last funding round, you will own \%. (Round to one decimal place.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts