Question: PLEASE ANSWER ALL Belkin is expected to pay an annual dividend of $12.38 one year from now. Dividends are expected to grow by 2.9% every

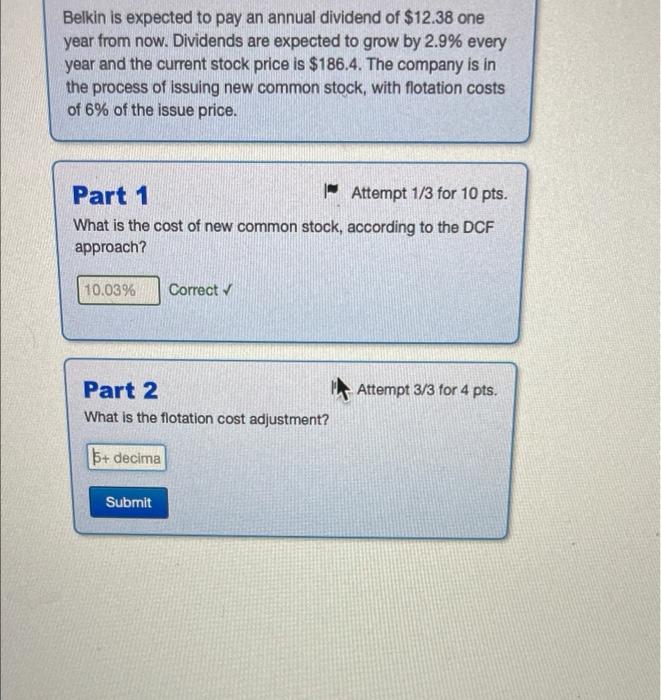

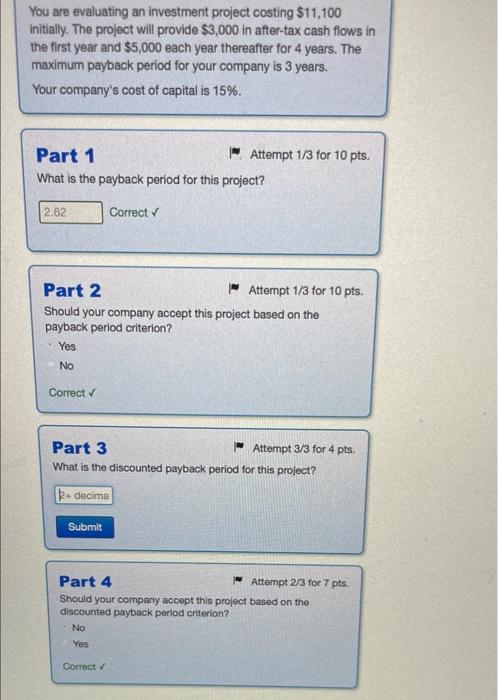

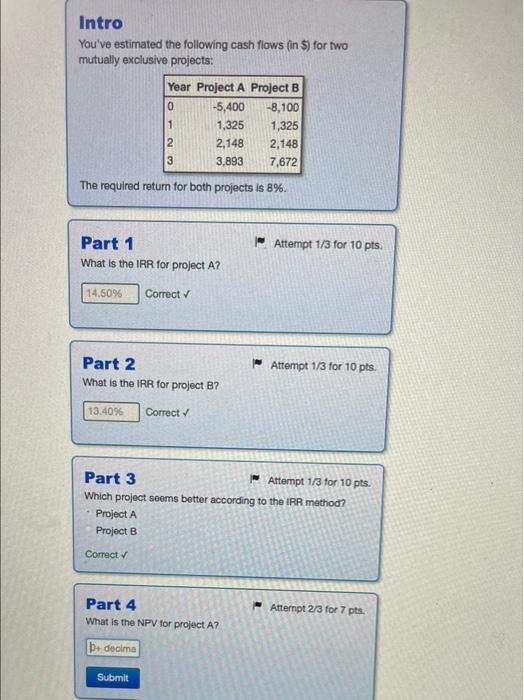

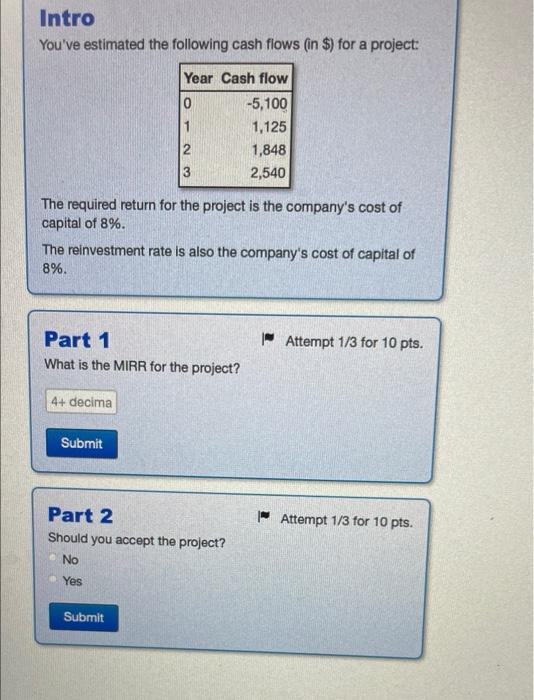

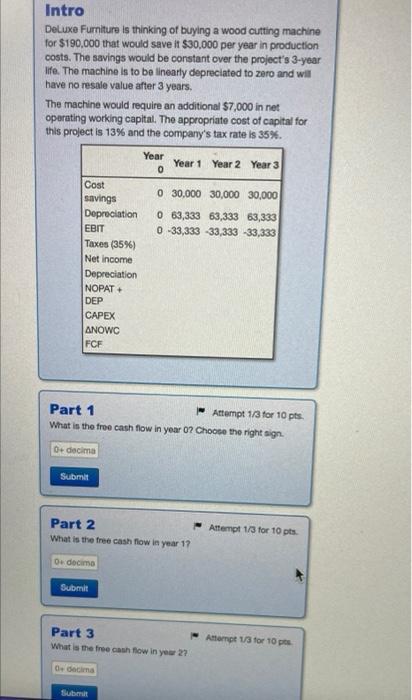

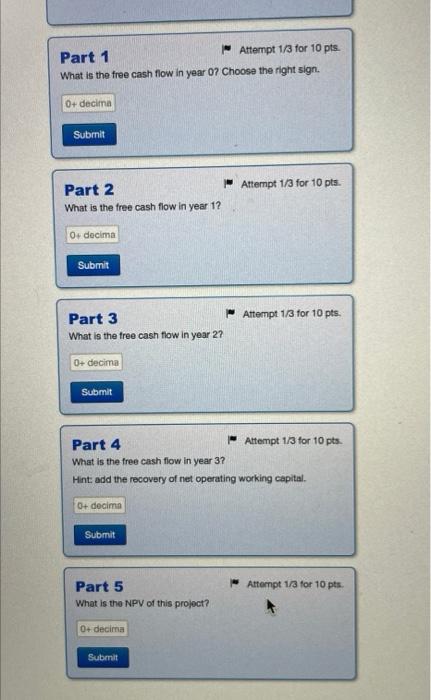

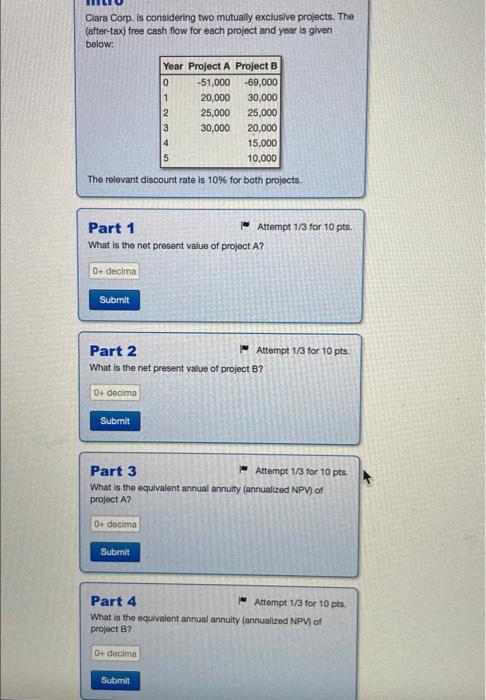

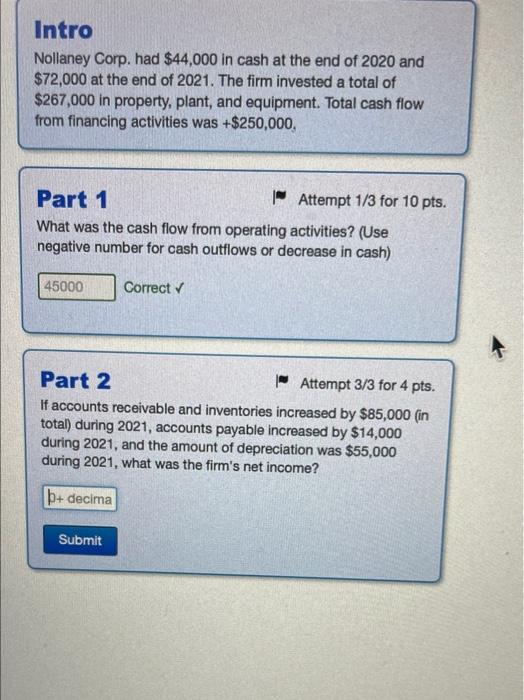

Belkin is expected to pay an annual dividend of $12.38 one year from now. Dividends are expected to grow by 2.9% every year and the current stock price is $186.4. The company is in the process of issuing new common stock, with flotation costs of 6% of the issue price. Part 1 | Attempt 1/3 for 10 pts. What is the cost of new common stock, according to the DCF approach? 10.03% Correct Attempt 3/3 for 4 pts. Part 2 What is the flotation cost adjustment? 5+ decima Submit You are evaluating an investment project costing $11,100 Initially. The project will provide $3,000 in after-tax cash flows in the first year and $5,000 each year thereafter for 4 years. The maximum payback period for your company is 3 years. Your company's cost of capital is 15%. Part 1 Attempt 1/3 for 10 pts. What is the payback period for this project? 2.62 Correct Part 2 Attempt 1/3 for 10 pts. Should your company accept this project based on the payback period criterion? Yes No Correct Part 3 Attempt 3/3 for 4 pts. What is the discounted payback period for this project? kdecima Submit Part 4 Attempt 2/3 for 7 pts. Should your company accept this project based on the discounted payback period criterion? - No Yes Correct Intro You've estimated the following cash flows (in $) for two mutually exclusive projects: Year Project A Project B 0 -5,400 -8,100 1 1,325 1,325 2 2,148 2,148 3 3,893 7,672 NO The required return for both projects is 8%. Attempt 1/3 for 10 pts. Part 1 What is the IRR for project A? 14.50% Correct Part 2 What is the IRR for project B? Attempt 1/3 for 10 pts. 13.4096 Correct Part 3 Attempt 1/3 for 10 pts. Which project seems better according to the IRR method? Project A Project B Correct Part 4 What is the NPV for project A? Attempt 2/3 for 7 pts. + decima Submit Intro You've estimated the following cash flows (in $) for a project: Year Cash flow 0 -5,100 1 1,125 2 1,848 3 2,540 The required return for the project is the company's cost of capital of 8%. The reinvestment rate is also the company's cost of capital of 8%. Part 1 What is the MIRR for the project? Attempt 1/3 for 10 pts. 4+ decima Submit - Attempt 1/3 for 10 pts. Part 2 Should you accept the project? No Yes Submit Intro Deluxe Furniture is thinking of buying a wood cutting machine for $190,000 that would save it $30,000 per year in production costs. The savings would be constant over the project's 3-year life. The machine is to be linearly depreciated to zero and will have no resale value after 3 years The machine would require an additional $7,000 in net operating working capital. The appropriate cost of capital for this project is 13% and the company's tax rate is 35%. Year Year 1 Year 2 Year 3 0 Cost 0 30,000 30,000 30,000 savings Depreciation 0 63,333 63,333 63,333 EBIT 0 -33,333 -33,333 33,333 Taxes (35%) Net Income Depreciation NOPAT DEP CAPEX ANOWC FCF Part 1 Attempt 1/3 for 10 pts. What is the free cash flow in year 02 Choose the right sign 0+dacima Submit Part 2 What is the free cash flow in year 17 Attempt 1/3 for 10 pts 0.docima Submit Part 3 What is the free cash flow in your 2? Attempt 13 for 10 po 0 decima Submit Part 1 Attempt 1/3 for 10 pts What is the free cash flow in year 07 Choose the right sign. 0+ decima Submit Attempt 1/3 for 10 pts. Part 2 What is the free cash flow in year 1? 0.decima Submit Attempt 1/3 for 10 pts. Part 3 What is the free cash flow in year 27 0+ decima Submit Part 4 Attempt 1/3 for 10 pts. What is the free cash flow in year 3? Hint: add the recovery of net operating working capital 0+ decima Submit Attempt 1/3 for 10 pts. Part 5 What is the NPV of this project? 0+ decima Submit Clara Corp. is considering two mutually exclusive projects. The (after-tax) free cash flow for each project and year is given below: Year Project A Project B 0 -51,000 -69,000 1 20,000 30,000 2 25,000 25,000 3 30,000 20,000 4 15.000 5 10,000 The relevant discount rate is 10% for both projects. Part 1 Attempt 1/3 for 10 pts. What is the net present value of project A? D+ decima Submit Part 2 Attempt 1/3 for 10 pts What is the net present value of project B? 0+ decima Submit Part 3 Attempt 1/3 for 10 pts. What is the equivalent annual annuity (annualized NPV) of project A? 0+ decima Submit Part 4 Attempt 1/3 for 10 pts. What is the equivalent annual annuity (annualized NPV) of project 87 0+ decima Submit Intro Nollaney Corp. had $44,000 in cash at the end of 2020 and $72,000 at the end of 2021. The firm invested a total of $267,000 in property, plant, and equipment. Total cash flow from financing activities was +$250,000, Part 1 - Attempt 1/3 for 10 pts. What was the cash flow from operating activities? (Use negative number for cash outflows or decrease in cash) 45000 Correct Part 2 - Attempt 3/3 for 4 pts. If accounts receivable and inventories increased by $85,000 (in total) during 2021, accounts payable increased by $14,000 during 2021, and the amount of depreciation was $55,000 during 2021, what was the firm's net income? + decima Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts