Question: please just answer part 2 instructions on how to do so are posted on part 2 as i got ot wrong. thanks. Intro Belkin is

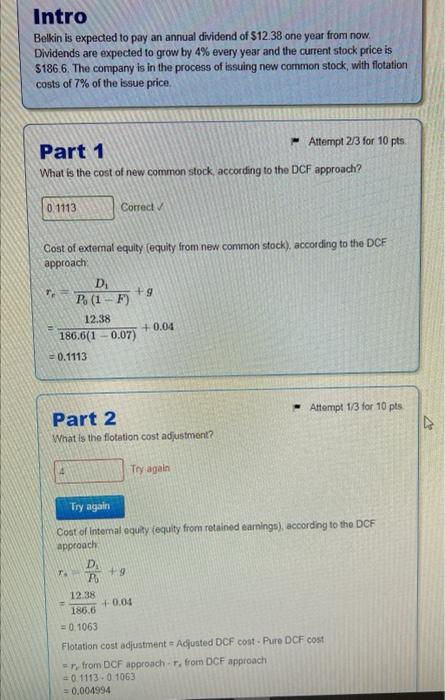

Intro Belkin is expected to pay an annual dividend of $12.38 one year from now. Dividends are expected to grow by 4% every year and the current stock price is \$186.6. The company is in the process of issuing new cormmon stock, with flotation costs of 7% of the issue price. Part 1 Attempt 2/3 for 10pts. What is the cost of new common stock, according to the DCF approach? Cost of extemal equity (equity from new common stock). according to the DCF approach: rr=P0(1F)D1+g=186.6(10.07)12.38+0.04=0.1113 Part 2 Attempt 1/3 for 10 pts What is the fotation cost adjustment? Cost of Intemal equity (equity from retained earnings), according to the DCF approach r==P0D1+9186.612.38+0.040.1063 Flotation cost adjustment = Adjuated DCF cost . Pure DCF cost =rrfrom DCF approsch r. from DCF approach a 0.1113+0.1063 =0.004994

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts