Question: Please answer all blanks. Many experts struggle with these questions so please double check your work. I will not connect elsewhere. Five years ago, your

Please answer all blanks. Many experts struggle with these questions so please double check your work. I will not connect elsewhere.

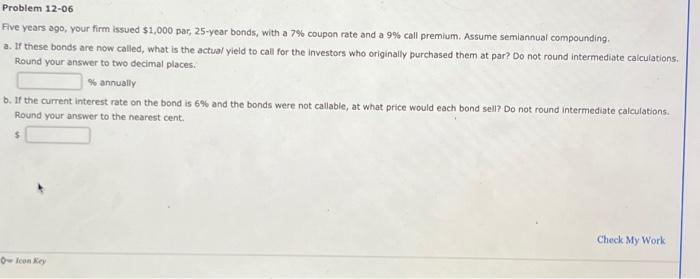

Five years ago, your firm issued $1,000 par, 25 -year bonds, with a 7% coupon rate and a 9% call premium. Assume semiannual compounding. a. If these bonds are now called, what is the actual yield to call for the investors who originally purchased them at par? Do not round intermediote calculations. Round your answer to two decimal places. \% annually b. If the current interest rate on the bond is 6% and the bonds were not callable, at what price would each bond sell? Do not round intermediate calculations. Round your answer to the nearest cent. 5

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock