Question: Please answer all blanks. Many experts struggle with these questions so please double check your work. I will not connect elsewhere. Bonds of Francesca Corporation

Please answer all blanks. Many experts struggle with these questions so please double check your work. I will not connect elsewhere.

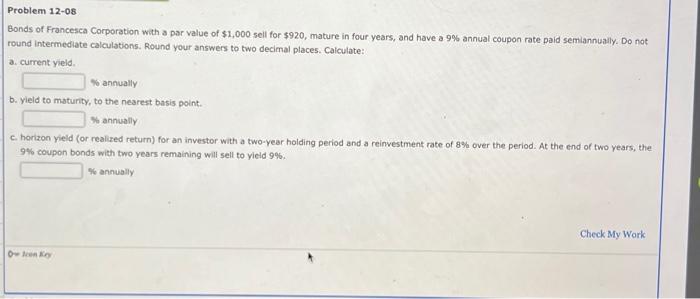

Bonds of Francesca Corporation with a par value of $1,000 sell for $920, mature in four years, and have a 9% annual coupon rate paid semiannually. Do not round intermediate calculations. Round your answers to two decimal places. Calculate: a. current yield. \% annually b. yield to maturity, to the nearest basis point. Wh annually c. horizon yield (or realized return) for an investor with a two-year holding period and a reinvestment rate of 8% over the period. At the end of two years, the 9% coupon bonds with two years remaining will sell to yield 9%. % ennually

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock