Question: Please answer all blanks. Many experts struggle with these questions so please double check your work. I will not connect elsewhere. Evaluate the following pure-yield

Please answer all blanks. Many experts struggle with these questions so please double check your work. I will not connect elsewhere.

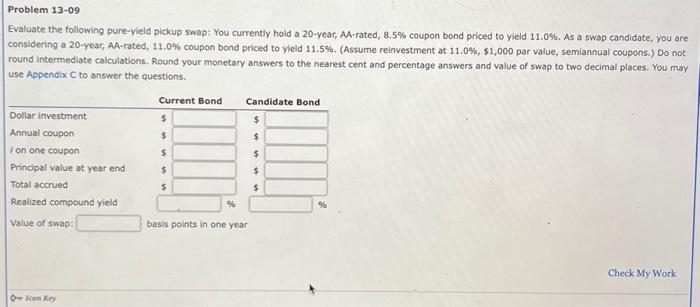

Evaluate the following pure-yield pickup swap: You currently hold a 20-year, A-rated, 8.5% coupon bond priced to yield 11.0%. As a swap candidate, you are considering a 20 -year, AA-rated, 11.0% coupon bond priced to yicld 11.5%. (Assume reinvestment at 11.0%,$1,000 par value, semiannual coupons.) Do not round intermediate calculations. Round your monetary answers to the nearest cent and percentage answers and value of swap to two decimal places. You may use Appendix C to answer the questions

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock