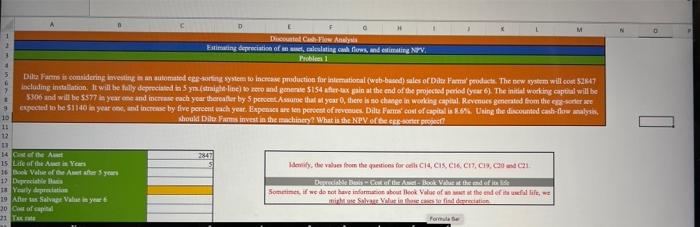

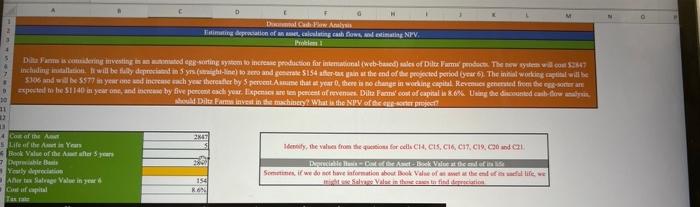

Question: please answer all empty cells c14-c21 O 1 D Dietariat Cafe Aias Estimating depreciation of calling cash flows and estimating NPV. Problem 1 Delta Farm

O 1 D Dietariat Cafe Aias Estimating depreciation of calling cash flows and estimating NPV. Problem 1 Delta Farm is comidering investing man automated ege-oring system to increase production for intematotal (web-based sales of Die Formal products. The new system will cout $2847 including installation. It will be fully deprecated in Syn(straight line) to me and gene 5154 after-tax pain at the end of the projected period (lystar 6). The initial working capital will be 5306 and will be $377 in year me and in each year thereafter by 5 perccel Assume that you, there is no change in working capiul Revenues generated from the expected to be $1140 in years, and increase by five percentach year. Expencuare ten percent of revenues Diluare cost of capital is 6%. Uning the discounted cash flow analysis, should Di Farm invest in the machinery? What is the NPV of the CE 10 11 12 2847 dily, the value then the questions for CH4, CIK CH CICIB, C C21 1 Case the 15 Lide of the Year 16 Book Value of the years 19 Deprecate * Yally preto 19 After a San Vale 20 CM of spital 1 TK Dedekle botefte Auce Book Vatten of Sometimes, if we do not have in about look Value of the end of the life, w mis Salt Vilain the hos to find derection Format De Cade.Abyss Timepation of an el casting and estimating NIV. Problem Du Fais vesting is de sorting systems to increase production for international web-based) sales of Dil Tumpendo. The new system wil.com 347 inchadigitation. I will be fully depending you (line) to and general $154 fra in the end of the projected period you 5). The initial working capital will be 5306 and 977 in year and increase chythereafter by Sporvet Asume that your, there is no change in working capital Revenue gefresher expected to be S1140 in year one, and increase by five percent ech you lixpenses respondent of revenues. Dil cost of capital la 80% Une de carbowy should Dil Farms invest in the machine? What is the NIV of the 10 11 2641 13 4 Co of he Life of the Year Book Value of the Amers Dahlem Yiyeciation Ahorts Salvage Valine Cut ur arital Tas Identify the values from the questions for celle CH4, CIS,CI, C17.019. Cdc21 Decolle Battback Voltat cand Some we have formation about Value of wettelul life we Sve Vales in there are to find depreciation 154 Ro O 1 D Dietariat Cafe Aias Estimating depreciation of calling cash flows and estimating NPV. Problem 1 Delta Farm is comidering investing man automated ege-oring system to increase production for intematotal (web-based sales of Die Formal products. The new system will cout $2847 including installation. It will be fully deprecated in Syn(straight line) to me and gene 5154 after-tax pain at the end of the projected period (lystar 6). The initial working capital will be 5306 and will be $377 in year me and in each year thereafter by 5 perccel Assume that you, there is no change in working capiul Revenues generated from the expected to be $1140 in years, and increase by five percentach year. Expencuare ten percent of revenues Diluare cost of capital is 6%. Uning the discounted cash flow analysis, should Di Farm invest in the machinery? What is the NPV of the CE 10 11 12 2847 dily, the value then the questions for CH4, CIK CH CICIB, C C21 1 Case the 15 Lide of the Year 16 Book Value of the years 19 Deprecate * Yally preto 19 After a San Vale 20 CM of spital 1 TK Dedekle botefte Auce Book Vatten of Sometimes, if we do not have in about look Value of the end of the life, w mis Salt Vilain the hos to find derection Format De Cade.Abyss Timepation of an el casting and estimating NIV. Problem Du Fais vesting is de sorting systems to increase production for international web-based) sales of Dil Tumpendo. The new system wil.com 347 inchadigitation. I will be fully depending you (line) to and general $154 fra in the end of the projected period you 5). The initial working capital will be 5306 and 977 in year and increase chythereafter by Sporvet Asume that your, there is no change in working capital Revenue gefresher expected to be S1140 in year one, and increase by five percent ech you lixpenses respondent of revenues. Dil cost of capital la 80% Une de carbowy should Dil Farms invest in the machine? What is the NIV of the 10 11 2641 13 4 Co of he Life of the Year Book Value of the Amers Dahlem Yiyeciation Ahorts Salvage Valine Cut ur arital Tas Identify the values from the questions for celle CH4, CIS,CI, C17.019. Cdc21 Decolle Battback Voltat cand Some we have formation about Value of wettelul life we Sve Vales in there are to find depreciation 154 Ro

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts