Question: Please Answer All Four :) 1. Company X has an equity value of $1,000M, total debt of 200M, cash & cash equivalents of 100M and

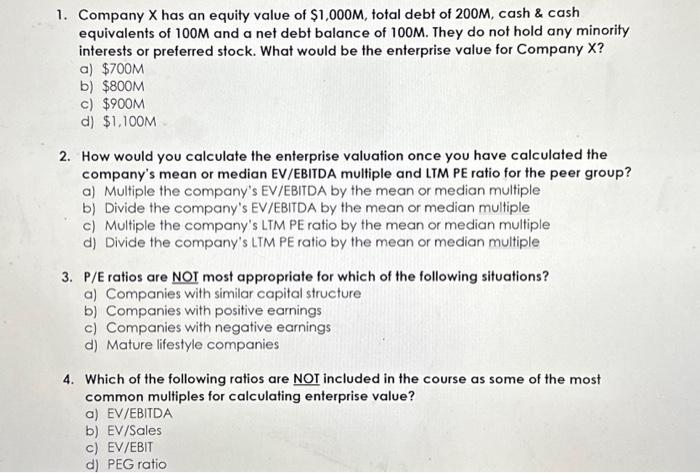

1. Company X has an equity value of $1,000M, total debt of 200M, cash \& cash equivalents of 100M and a net debt balance of 100M. They do not hold any minority interests or preferred stock. What would be the enterprise value for Company X ? a) $700M b) $800M c) $900M d) $1.100M 2. How would you calculate the enterprise valuation once you have calculated the company's mean or median EV/EBITDA multiple and LIM PE ratio for the peer group? a) Multiple the company's EV/EBITDA by the mean or median multiple b) Divide the company's EV/EBITDA by the mean or median multiple c) Multiple the company's LTM PE ratio by the mean or median multiple d) Divide the company's LTM PE ratio by the mean or median multiple 3. P/E ratios are NOI most appropriate for which of the following situations? a) Companies with similar capital structure b) Companies with positive earnings c) Companies with negative earnings d) Mature lifestyle companies 4. Which of the following ratios are NOI included in the course as some of the most common multiples for calculating enterprise value? a) EV/EBITDA b) EV/ Sales c) EV/EBIT d) PEG ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts