Question: please answer all Larkin Hydraules. On May 1, Lekin Hydreulcs, o wholy owned subsdiary of Calerpildr (US.) soid a 12 -neganst compiession tuabine io Rebecke.

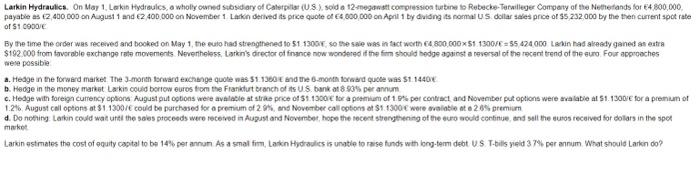

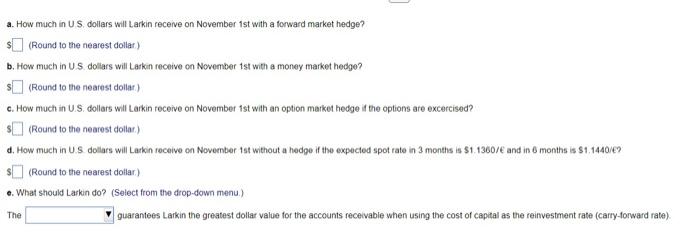

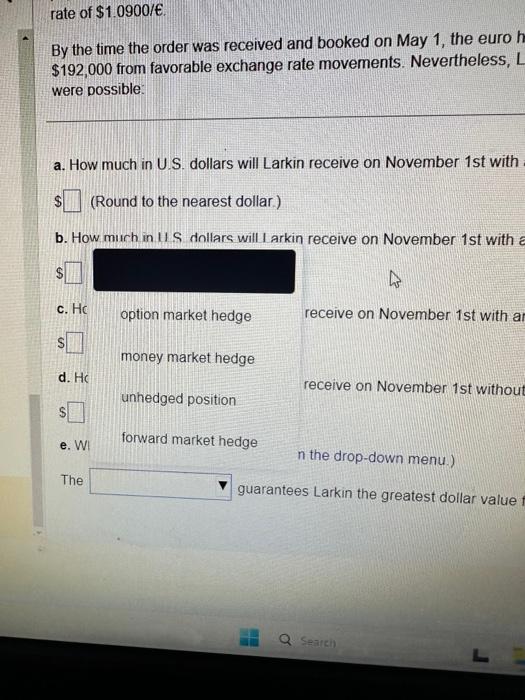

Larkin Hydraules. On May 1, Lekin Hydreulcs, o wholy owned subsdiary of Calerpildr (US.) soid a 12 -neganst compiession tuabine io Rebecke. Tarnilleger Conpery of the Nethetands for E4. Bo0, 000, of 51 copove $192.005 from tavoroble exchange rele movenents. Nevertheless. Larkn's director of france now wondered if the fim should bedge apuingt a reversal of the recart terend of the furo. Four acpoeches reve possibie b. Heoge in the money marke Lakis coulo borrow euros tom the Frariktur bronch of th U.S. bank at 893 th per annum maket a. How much in U.S, dollars will Larkin recerve on November 1st with a forward market hedge? $ (Round to the nearest dollar.) b. How much in US dollars will Larkin receive on November 1st with a money market hedge? (Round to the nearest dollar) c. How much in U.S. dollars wil Larkin receive on November 1st with an option market hedge if the options are excercised? S. (Round to the nearest doliar.) d. How much in U.S. dollars will Larkin receive on Novernber 15st without a hedge if the expected spot rate in 3 months is $1.1360/6 and in 6 months is $1.1440/ ? \$ (Round to the nearest dollar) e. What should Larkin do? (Select from the drop-down menu.) The guarantees Larkin the greatest dollar value for the accounts receivable when using the cost of capital as the reinvestment rate (carry-forward rate). rate of $1.0900/. By the time the order was received and booked on May 1 , the euro $192,000 from favorable exchange rate movements. Nevertheless, L were possible: a. How much in U.S. dollars will Larkin receive on November 1st with (Round to the nearest dollar.) b. How much in 11 S dollars will 1 arkin receive on November 1 st with c. Hc option market hedge receive on November 1 st with at s money market hedge d. HC unhedged position receive on November 1 st without

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts