Question: please answer all or none these two go together > Question 7 1 pts Given a share of preferred stock with a quarterly dividend of

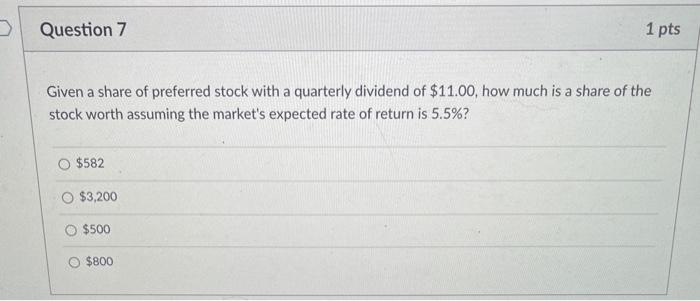

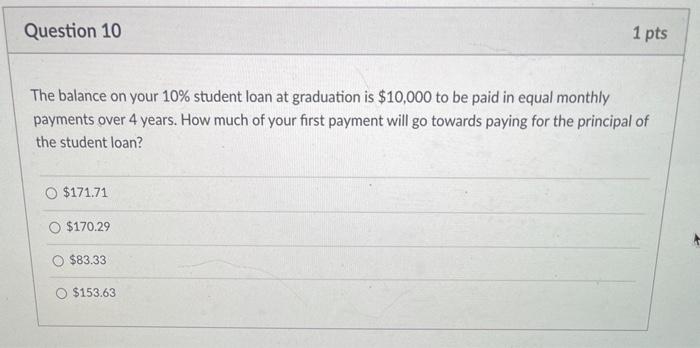

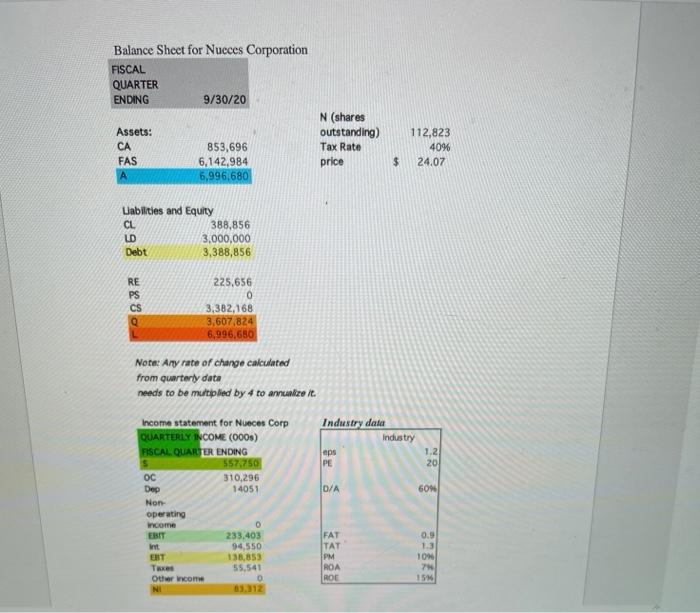

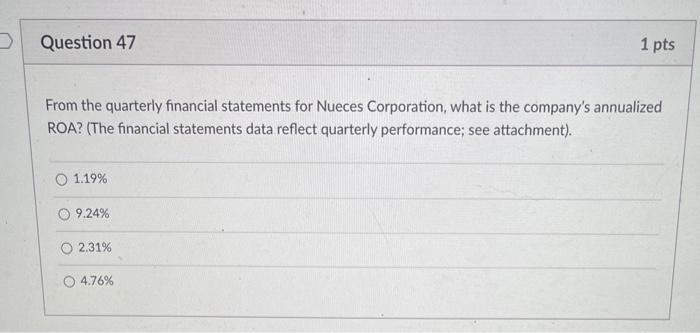

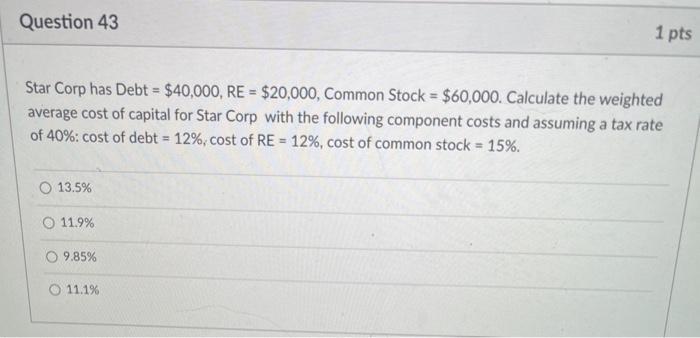

> Question 7 1 pts Given a share of preferred stock with a quarterly dividend of $11.00, how much is a share of the stock worth assuming the market's expected rate of return is 5.5%? $582 O $3,200 O $500 $800 Question 10 1 pts The balance on your 10% student loan at graduation is $10,000 to be paid in equal monthly payments over 4 years. How much of your first payment will go towards paying for the principal of the student loan? $171.71 O $170.29 O $83.33 O $153.63 Balance Sheet for Nucces Corporation FISCAL QUARTER ENDING 9/30/20 Assets: CA FAS A N (shares outstanding) Tax Rate price 853,696 6,142,984 6,996,680 112,823 40% 24.07 $ Liabilities and Equity CL 388,856 LD 3,000,000 Debt 3,388,856 RE CS 225,656 0 3,382,168 3,607,824 6,996,680 Note: Any rate of charge calculated from quarterly date needs to be multiplied by 4 to amunize it. Industry data Industry eps PE 1.2 20 10/A 60% Income statement for Nueces Corp QUARTERLY INCOME (0005) FISCAL QUARTER ENDING 557,750 OC 310,296 Dep 14051 Non operating Income 0 EBIT 233,403 int 94.550 ERT 138.853 Taxe 55,541 Other Wome NI 63,312 FAT TAT PM ROA ROE 0.9 1.3 10 7 154 O 1 pts Question 48 The industry wherein Nueces operates has a 60% average debt to asset ratio. (See attachment). Nueces should use relatively more retained earnings to finance new growth opportunities use relatively more common stock to finance new growth opportunities use relatively more preferred stock to finance new growth opportunities use relatively more debt to finance new growth opportunities Question 47 1 pts From the quarterly financial statements for Nueces Corporation, what is the company's annualized ROA? (The financial statements data reflect quarterly performance; see attachment). 1.19% 9.24% 2.31% 0 4.76% Question 43 1 pts Star Corp has Debt = $40,000, RE = $20,000, Common Stock = $60,000. Calculate the weighted average cost of capital for Star Corp with the following component costs and assuming a tax rate of 40%: cost of debt = 12%, cost of RE = 12%, cost of common stock = 15%. O 13.5% O 11.9% 9.85% 11.1%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts