Question: Please answer all part A-C, and please show all work and functions used in Excel calculations. Thanks. 1. A large mortgage lender, your employer, has

Please answer all part A-C, and please show all work and functions used in Excel calculations. Thanks.

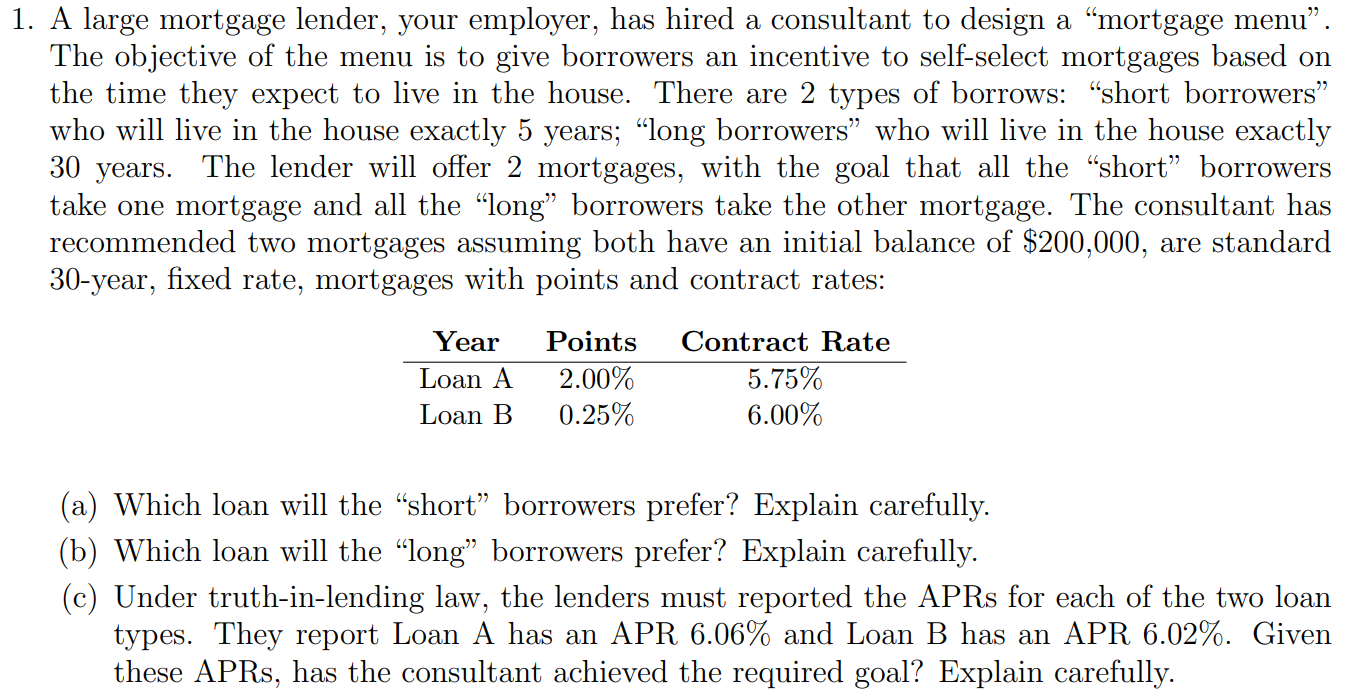

1. A large mortgage lender, your employer, has hired a consultant to design a mortgage menu. The objective of the menu is to give borrowers an incentive to self-select mortgages based on the time they expect to live in the house. There are 2 types of borrows: "short borrowers who will live in the house exactly 5 years; long borrowers who will live in the house exactly 30 years. The lender will offer 2 mortgages, with the goal that all the short borrowers take one mortgage and all the long" borrowers take the other mortgage. The consultant has recommended two mortgages assuming both have an initial balance of $200,000, are standard 30-year, fixed rate, mortgages with points and contract rates: Year Loan A Loan B Points 2.00% 0.25% Contract Rate 5.75% 6.00% (a) Which loan will the short borrowers prefer? Explain carefully. (b) Which loan will the long borrowers prefer? Explain carefully. (c) Under truth-in-lending law, the lenders must reported the APRs for each of the two loan types. They report Loan A has an APR 6.06% and Loan B has an APR 6.02%. Given these APRs, has the consultant achieved the required goal? Explain carefully. 1. A large mortgage lender, your employer, has hired a consultant to design a mortgage menu. The objective of the menu is to give borrowers an incentive to self-select mortgages based on the time they expect to live in the house. There are 2 types of borrows: "short borrowers who will live in the house exactly 5 years; long borrowers who will live in the house exactly 30 years. The lender will offer 2 mortgages, with the goal that all the short borrowers take one mortgage and all the long" borrowers take the other mortgage. The consultant has recommended two mortgages assuming both have an initial balance of $200,000, are standard 30-year, fixed rate, mortgages with points and contract rates: Year Loan A Loan B Points 2.00% 0.25% Contract Rate 5.75% 6.00% (a) Which loan will the short borrowers prefer? Explain carefully. (b) Which loan will the long borrowers prefer? Explain carefully. (c) Under truth-in-lending law, the lenders must reported the APRs for each of the two loan types. They report Loan A has an APR 6.06% and Loan B has an APR 6.02%. Given these APRs, has the consultant achieved the required goal? Explain carefully

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts