Question: please answer all portions of question (Computing the standard deviation for a portfollo of two risky imvestments) Mary Gueltt recently graduated from Nechols State Univorsity

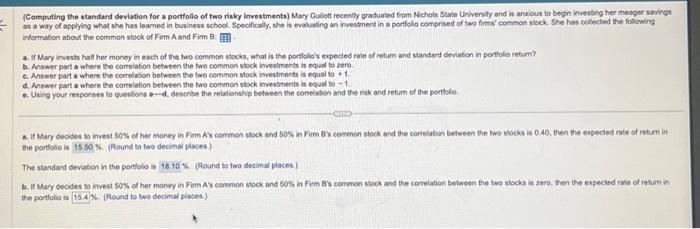

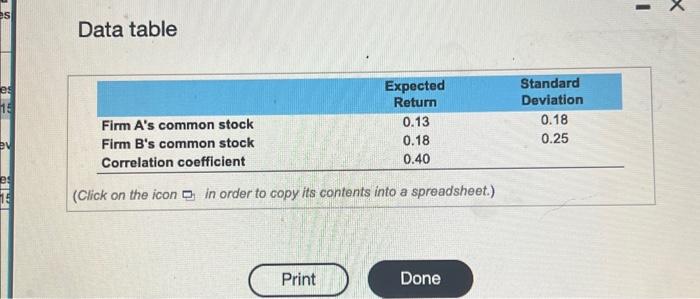

(Computing the standard deviation for a portfollo of two risky imvestments) Mary Gueltt recently graduated from Nechols State Univorsity and is anxious to begin imveiting her meager sovings information about the common stock of Fim A and Fim B a. If May invests halt her money in each of tha two comman stocks, what is the portolo's expecied rate of retum and standard deviation in portlolio retium? b. Answer part where the corrolotion between the bwo common stock investments is equal to rero c. Answer part a where the correlation between the two common stock imestments is equal to +1 d. Answer part s where the correlation between the two common stock imvestments is equal to -1 . the partiobio is (Round to twe decinal places) The standard deviston in the portolo is (1. (Pound so two decimal places.) b. If Mary decides to invest 50% of her money in Firm A s common stock and 50% in Fim B's common stock mo the correlation between the swo stocks is zero, then the expected rate of retum in the porticlio ia 6. (Round to two decimal places.) Data table (Click on the icon in order to copy its contents into a spreadsheet.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts