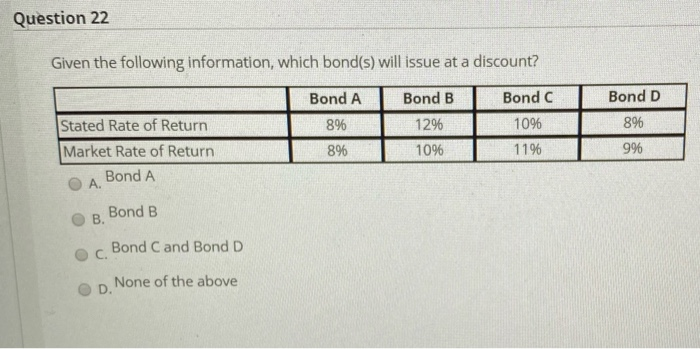

Question: please answer all. Question 22 Given the following information, which bond(s) will issue at a discount? Bond A Bond B 12% Bond C 1096 Bond

please answer all.

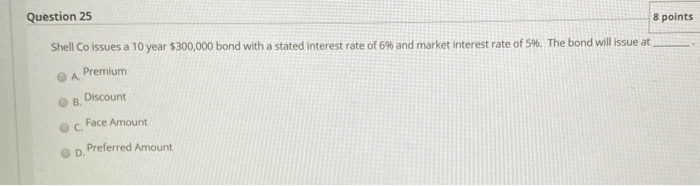

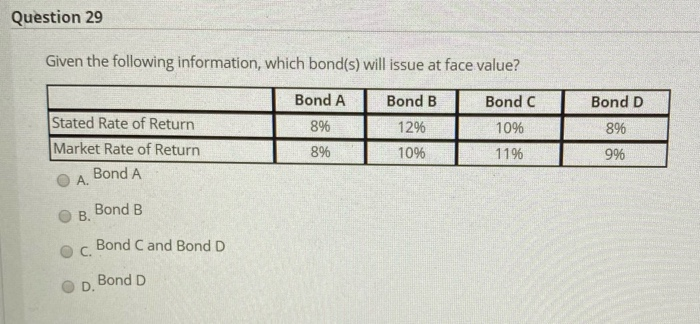

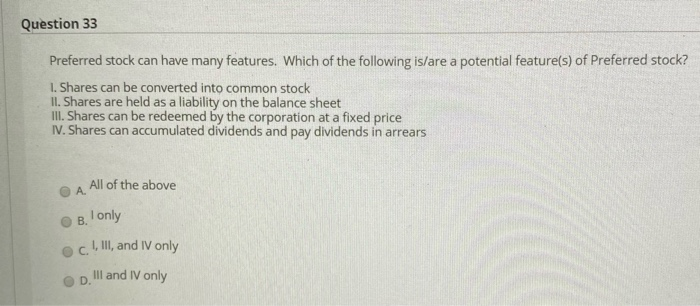

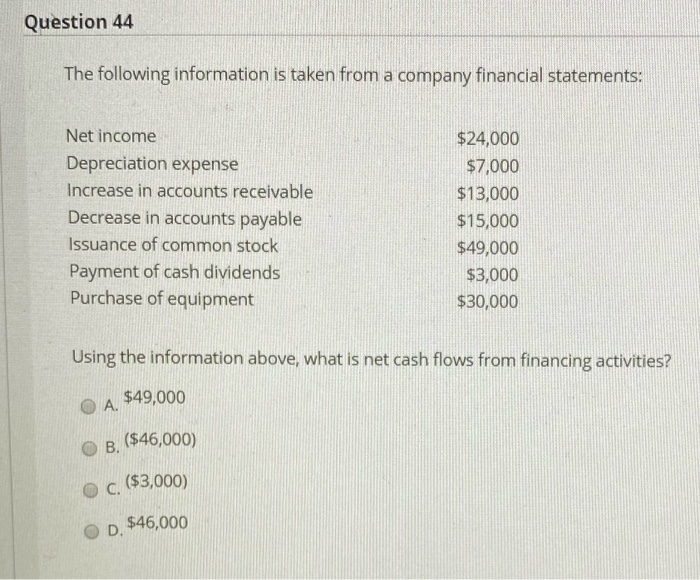

please answer all.Question 22 Given the following information, which bond(s) will issue at a discount? Bond A Bond B 12% Bond C 1096 Bond D 896 896 Stated Rate of Return Market Rate of Return A. Bond A 896 1096 1196 996 B. Bond B Bond C and Bond D C. D. None of the above Question 25 8 points Shell Co issues a 10 year $300,000 bond with a stated interest rate of 6% and market interest rate of 5%. The bond will issue at Premium A OB Discount Face Amount . OD Preferred Amount Question 29 Given the following information, which bond(s) will issue at face value? Bond C Bond D Bond A 896 Bond B 1296 10% 10% Stated Rate of Return Market Rate of Return A Bond A 896 9% 8% 119 B. Bond B Bond C and Bond D C. Bond D D. Question 33 Preferred stock can have many features. Which of the following is/are a potential feature(s) of Preferred stock? 1. Shares can be converted into common stock II. Shares are held as a liability on the balance sheet III. Shares can be redeemed by the corporation at a fixed price IV. Shares can accumulated dividends and pay dividends in arrears All of the above A. B. only C I, III, and IV only III and IV only D Question 44 The following information is taken from a company financial statements: Net income Depreciation expense Increase in accounts receivable Decrease in accounts payable Issuance of common stock Payment of cash dividends Purchase of equipment $24,000 $7,000 $13,000 $15,000 $49,000 $3,000 $30,000 Using the information above, what is net cash flows from financing activities? $49,000 O A. B. ($46,000) ($3,000) OC. D. $46,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts