Question: Please answer all questions. C) Kenneth would include the rental receipts in gross income and would not deduct the rental expenses because he used the

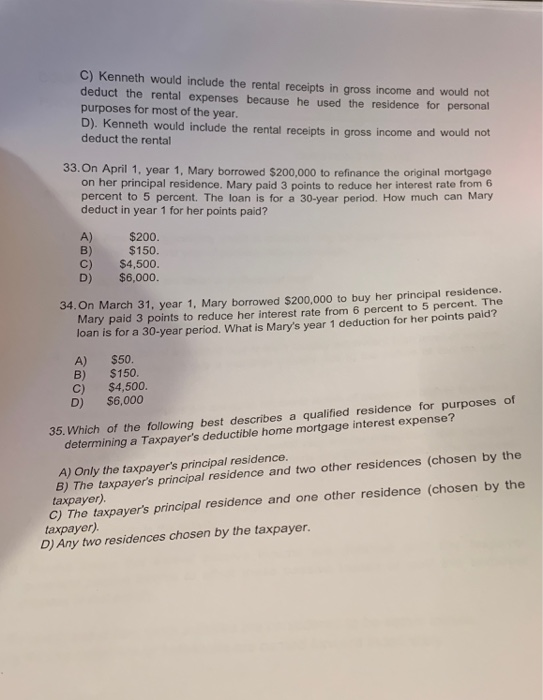

C) Kenneth would include the rental receipts in gross income and would not deduct the rental expenses because he used the residence for personal purposes for most of the year. D). Kenneth would include the rental receipts in gross income and would not deduct the rental 33.On April 1, year 1, Mary borrowed $200,000 to refinance the original mortgage on her principal residence. Mary paid 3 points to reduce her interest rate from 6 percent to 5 percent. The loan is for a 30-year period. How much can Mary deduct in year 1 for her points paid? A) $200 B) C) $4,500. D) $6,000. $150. 34. On March 31, year 1, Mary borrowed $200,000 to buy her principal residence. Mary paid 3 points to reduce her interest rate from 6 percent to 5 percent. The loan is for a 30-year period. What is Mary's year 1 deduction for her points paid? A) $50. B) $150 C) $4,500. D) $6,000 35. Which of the following best describes a qualified residence for purposes of determining a Taxpayer's deductible home mortgage interest expense? A) Only the taxpayer's principal residence. B) The taxpayer's principal residence and two other residences (chosen by the taxpayer) c) The taxpayers principal residence and one other residence (chosen by the taxpayer) D) Any two residences chosen by the taxpayer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts