Question: please answer all questions completely using multiple choice. Your estimate of the market risk premium is 9%. The risk-free rate of return is 3.8% and

please answer all questions completely using multiple choice.

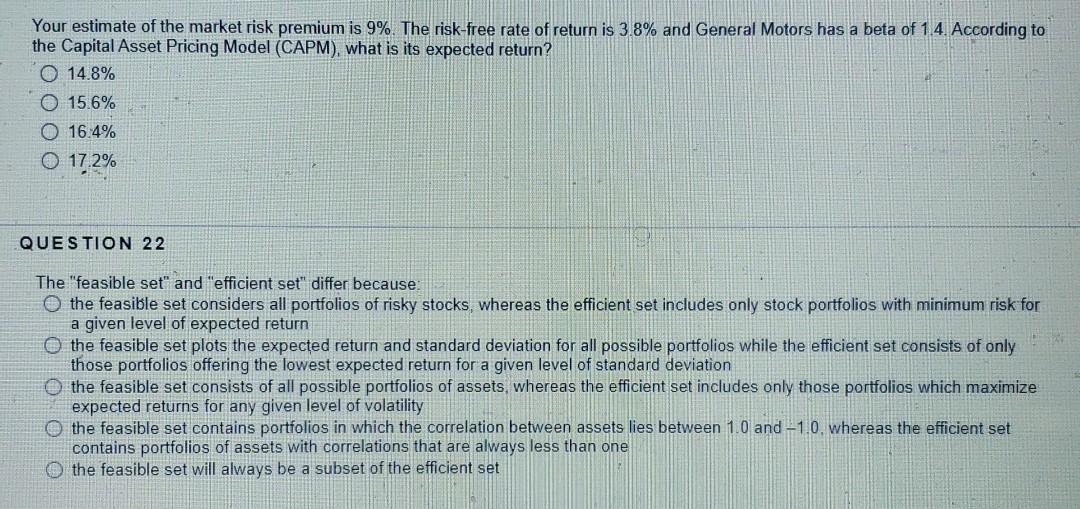

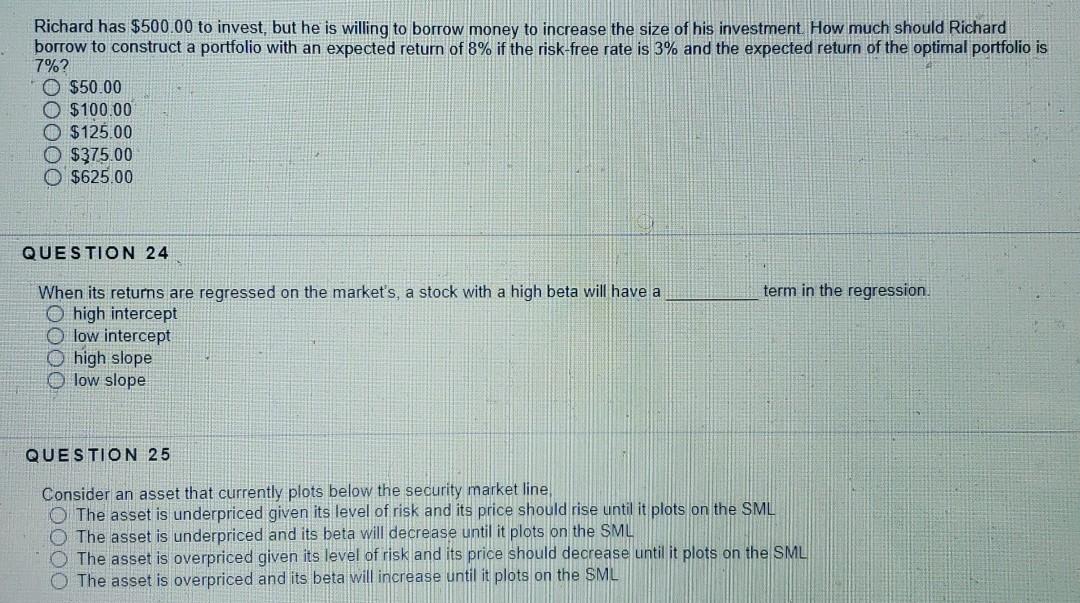

Your estimate of the market risk premium is 9%. The risk-free rate of return is 3.8% and General Motors has a beta of 1 4 According to the Capital Asset Pricing Model (CAPM), what is its expected return? 14.8% 15.6% O 16.4% O 17.2% QUESTION 22 The "feasible set" and "efficient set" differ because: o the feasible set considers all portfolios of risky stocks, whereas the efficient set includes only stock portfolios with minimum risk for a given level of expected return the feasible set plots the expected return and standard deviation for all possible portfolios while the efficient set consists of only those portfolios offering the lowest expected return for a given level of standard deviation the feasible set consists of all possible portfolios of assets, whereas the efficient set includes only those portfolios which maximize expected returns for any given level of volatility the feasible set contains portfolios in which the correlation between assets lies between 1.0 and -1.0, whereas the efficient set contains portfolios of assets with correlations that are always less than one the feasible set will always be a subset of the efficient set Richard has $500.00 to invest, but he is willing to borrow money to increase the size of his investment How much should Richard borrow to construct a portfolio with an expected return of 8% if the risk-free rate is 3% and the expected return the optimal portfolio is 7%? O $50.00 O $100.00 O $125.00 O $375.00 $625.00 QUESTION 24 term in the regression. When its returns are regressed on the market's, a stock with a high beta will have a high intercept O low intercept high slope low slope QUESTION 25 Consider an asset that currently plots below the security market line The asset is underpriced given its level of risk and its price should rise until it plots on the SML O The asset is underpriced and its beta will decrease until it plots on the SML The asset is overpriced given its level of risk and its price should decrease until it plots on the SML The asset is overpriced and its beta will increase until it plots on the SML

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts