Question: PLEASE ANSWER ALL QUESTIONS OR DO NOT ANSWER THEM AT ALL!!! WILL GIVE THUMBS UP IF ALL ARE ANSWERED For questions 6-8, refer to the

PLEASE ANSWER ALL QUESTIONS OR DO NOT ANSWER THEM AT ALL!!! WILL GIVE THUMBS UP IF ALL ARE ANSWERED

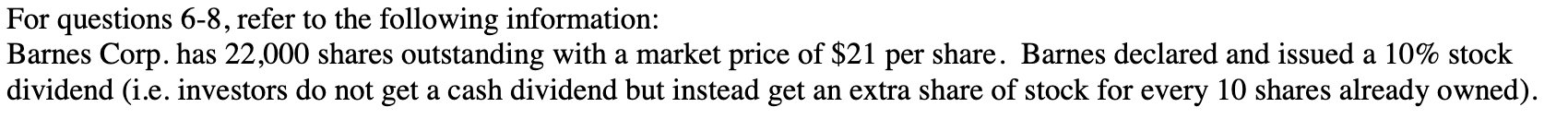

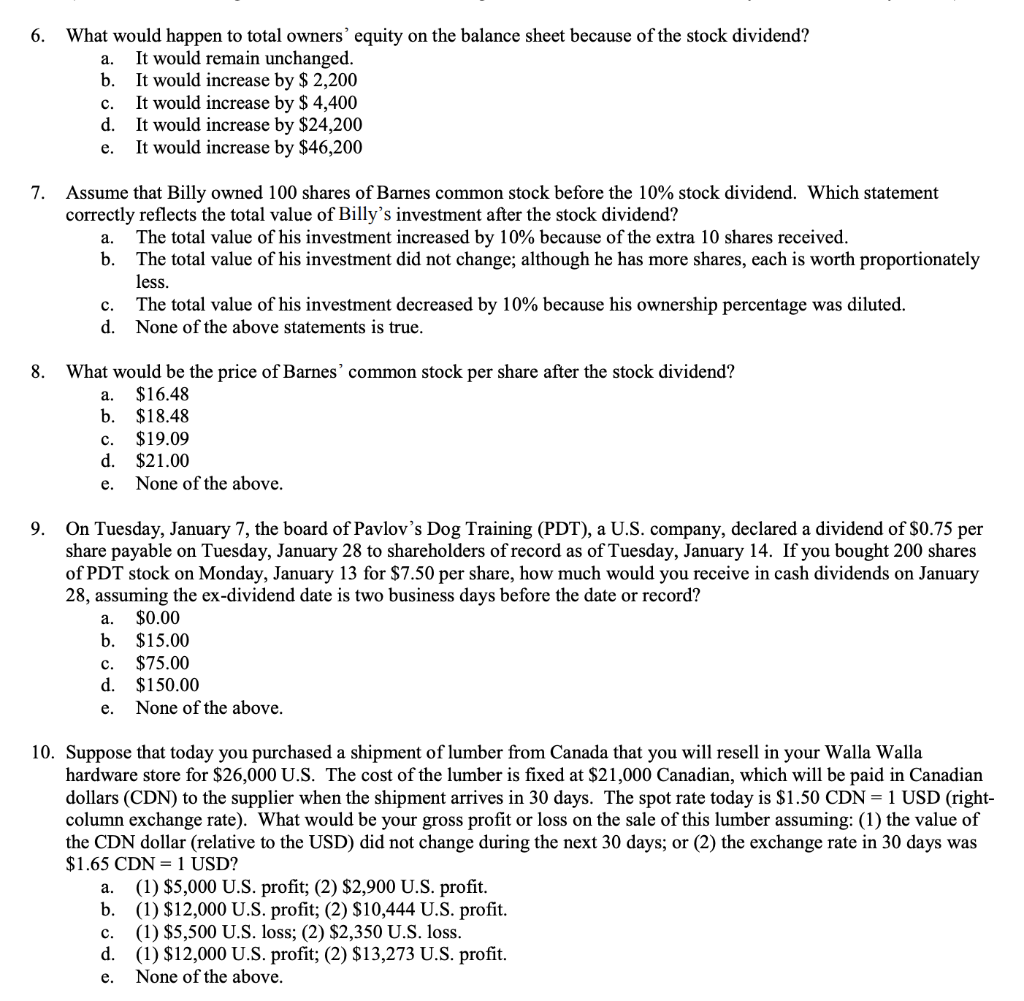

For questions 6-8, refer to the following information: Barnes Corp. has 22,000 shares outstanding with a market price of $21 per share. Barnes declared and issued a 10% stock dividend (i.e. investors do not get a cash dividend but instead get an extra share of stock for every 10 shares already owned). 6. a. What would happen to total owners' equity on the balance sheet because of the stock dividend? It would remain unchanged. b. It would increase by $ 2,200 c. It would increase by $ 4,400 d. It would increase by $24,200 It would increase by $46,200 e. 7. a. Assume that Billy owned 100 shares of Barnes common stock before the 10% stock dividend. Which statement correctly reflects the total value of Billy's investment after the stock dividend? The total value of his investment increased by 10% because of the extra 10 shares received. b. The total value of his investment did not change; although he has more shares, each is worth proportionately less. The total value of his investment decreased by 10% because his ownership percentage was diluted. d. None of the above statements is true. c. 8. What would be the price of Barnes' common stock per share after the stock dividend? a. $16.48 b. $18.48 c. $19.09 d. $21.00 e. None of the above. 9. On Tuesday, January 7, the board of Pavlov's Dog Training (PDT), a U.S. company, declared a dividend of $0.75 per share payable on Tuesday, January 28 to shareholders of record as of Tuesday, January 14. If you bought 200 shares of PDT stock on Monday, January 13 for $7.50 per share, how much would you receive in cash dividends on January 28, assuming the ex-dividend date is two business days before the date or record? a. $0.00 b. $15.00 $75.00 d. $150.00 None of the above. C. e. 10. Suppose that today you purchased a shipment of lumber from Canada that you will resell in your Walla Walla hardware store for $26,000 U.S. The cost of the lumber is fixed at $21,000 Canadian, which will be paid in Canadian dollars (CDN) to the supplier when the shipment arrives in 30 days. The spot rate today is $1.50 CDN = 1 USD (right- column exchange rate). What would be your gross profit or loss on the sale of this lumber assuming: (1) the value of the CDN dollar (relative to the USD) did not change during the next 30 days; or (2) the exchange rate in 30 days was $1.65 CDN = 1 USD? a. (1) $5,000 U.S. profit; (2) $2,900 U.S. profit. b. (1) $12,000 U.S. profit; (2) $10,444 U.S. profit. (1) $5,500 U.S. loss; (2) $2,350 U.S. loss. d. (1) $12,000 U.S. profit; (2) $13,273 U.S. profit. None of the above. c. e. For questions 6-8, refer to the following information: Barnes Corp. has 22,000 shares outstanding with a market price of $21 per share. Barnes declared and issued a 10% stock dividend (i.e. investors do not get a cash dividend but instead get an extra share of stock for every 10 shares already owned). 6. a. What would happen to total owners' equity on the balance sheet because of the stock dividend? It would remain unchanged. b. It would increase by $ 2,200 c. It would increase by $ 4,400 d. It would increase by $24,200 It would increase by $46,200 e. 7. a. Assume that Billy owned 100 shares of Barnes common stock before the 10% stock dividend. Which statement correctly reflects the total value of Billy's investment after the stock dividend? The total value of his investment increased by 10% because of the extra 10 shares received. b. The total value of his investment did not change; although he has more shares, each is worth proportionately less. The total value of his investment decreased by 10% because his ownership percentage was diluted. d. None of the above statements is true. c. 8. What would be the price of Barnes' common stock per share after the stock dividend? a. $16.48 b. $18.48 c. $19.09 d. $21.00 e. None of the above. 9. On Tuesday, January 7, the board of Pavlov's Dog Training (PDT), a U.S. company, declared a dividend of $0.75 per share payable on Tuesday, January 28 to shareholders of record as of Tuesday, January 14. If you bought 200 shares of PDT stock on Monday, January 13 for $7.50 per share, how much would you receive in cash dividends on January 28, assuming the ex-dividend date is two business days before the date or record? a. $0.00 b. $15.00 $75.00 d. $150.00 None of the above. C. e. 10. Suppose that today you purchased a shipment of lumber from Canada that you will resell in your Walla Walla hardware store for $26,000 U.S. The cost of the lumber is fixed at $21,000 Canadian, which will be paid in Canadian dollars (CDN) to the supplier when the shipment arrives in 30 days. The spot rate today is $1.50 CDN = 1 USD (right- column exchange rate). What would be your gross profit or loss on the sale of this lumber assuming: (1) the value of the CDN dollar (relative to the USD) did not change during the next 30 days; or (2) the exchange rate in 30 days was $1.65 CDN = 1 USD? a. (1) $5,000 U.S. profit; (2) $2,900 U.S. profit. b. (1) $12,000 U.S. profit; (2) $10,444 U.S. profit. (1) $5,500 U.S. loss; (2) $2,350 U.S. loss. d. (1) $12,000 U.S. profit; (2) $13,273 U.S. profit. None of the above. c. e

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts