Question: PLEASE ANSWER ALL QUESTIONS OR DO NOT ANSWER ANY AT ALL!!! WILL GIVE THUMBS UP IF THEY ALL ARE ANSWERED c. Which of the following

PLEASE ANSWER ALL QUESTIONS OR DO NOT ANSWER ANY AT ALL!!! WILL GIVE THUMBS UP IF THEY ALL ARE ANSWERED

PLEASE ANSWER ALL QUESTIONS OR DO NOT ANSWER ANY AT ALL!!! WILL GIVE THUMBS UP IF THEY ALL ARE ANSWERED

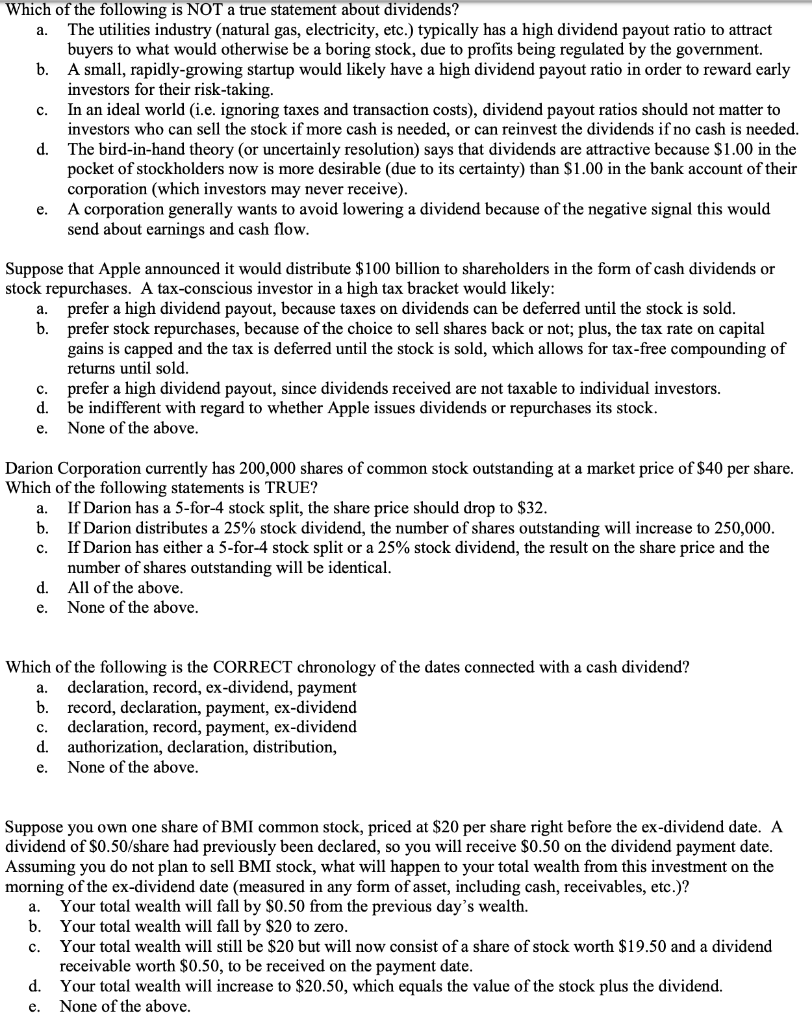

c. Which of the following is NOT a true statement about dividends? a. The utilities industry (natural gas, electricity, etc.) typically has a high dividend payout ratio to attract buyers to what would otherwise be a boring stock, due to profits being regulated by the government. b. A small, rapidly-growing startup would likely have a high dividend payout ratio in order to reward early investors for their risk-taking. In an ideal world (i.e. ignoring taxes and transaction costs), dividend payout ratios should not matter to investors who can sell the stock if more cash is needed, can reinvest the dividends if no cash is needed. d. The bird-in-hand theory (or uncertainly resolution) says that dividends are attractive because $1.00 in the pocket of stockholders now is more desirable (due to its certainty) than $1.00 in the bank account of their corporation (which investors may never receive). A corporation generally wants to avoid lowering a dividend because of the negative signal this would send about earnings and cash flow. e. a. Suppose that Apple announced it would distribute $ 100 billion to shareholders in the form of cash dividends or stock repurchases. A tax-conscious investor in a high tax bracket would likely: prefer a high dividend payout, because taxes on dividends can be deferred until the stock is sold. b. prefer stock repurchases, because of the choice to sell shares back or not; plus, the tax rate on capital gains is capped and the tax is deferred until the stock is sold, which allows for tax-free compounding of returns until sold. prefer a high dividend payout, since dividends received are not taxable to individual investors. d. be indifferent with regard to whether Apple issues dividends or repurchases its stock. None of the above. c. e. a. Darion Corporation currently has 200,000 shares of common stock outstanding at a market price of $40 per share. Which of the following statements is TRUE? If Darion has a 5-for-4 stock split, the share price should drop to $32. b. If Darion distributes a 25% stock dividend, the number of shares outstanding will increase to 250,000. If Darion has either a 5-for-4 stock split or a 25% stock dividend, the result on the share price and the number of shares outstanding will be identical. d. All of the above. None of the above. c. e. a. Which of the following is the CORRECT chronology of the dates connected with a cash dividend? declaration, record, ex-dividend, payment b. record, declaration, payment, ex-dividend declaration, record, payment, ex-dividend d. authorization, declaration, distribution, None of the above. c. e. a. Suppose you own one share of BMI common stock, priced at $20 per share right before the ex-dividend date. A dividend of $0.50/share had previously been declared, so you will receive $0.50 on the dividend payment date. Assuming you do not plan to sell BMI stock, what will happen to your total wealth from this investment on the morning of the ex-dividend date (measured in any form of asset, including cash, receivables, etc.)? Your total wealth will fall by $0.50 from the previous day's wealth. b. Your total wealth will fall by $20 to zero. Your total wealth will still be $20 but will now consist of a share of stock worth $19.50 and a dividend receivable worth $0.50, to be received on the payment date. d. Your total wealth will increase to $20.50, which equals the value of the stock plus the dividend. None of the above. c. e. c. Which of the following is NOT a true statement about dividends? a. The utilities industry (natural gas, electricity, etc.) typically has a high dividend payout ratio to attract buyers to what would otherwise be a boring stock, due to profits being regulated by the government. b. A small, rapidly-growing startup would likely have a high dividend payout ratio in order to reward early investors for their risk-taking. In an ideal world (i.e. ignoring taxes and transaction costs), dividend payout ratios should not matter to investors who can sell the stock if more cash is needed, can reinvest the dividends if no cash is needed. d. The bird-in-hand theory (or uncertainly resolution) says that dividends are attractive because $1.00 in the pocket of stockholders now is more desirable (due to its certainty) than $1.00 in the bank account of their corporation (which investors may never receive). A corporation generally wants to avoid lowering a dividend because of the negative signal this would send about earnings and cash flow. e. a. Suppose that Apple announced it would distribute $ 100 billion to shareholders in the form of cash dividends or stock repurchases. A tax-conscious investor in a high tax bracket would likely: prefer a high dividend payout, because taxes on dividends can be deferred until the stock is sold. b. prefer stock repurchases, because of the choice to sell shares back or not; plus, the tax rate on capital gains is capped and the tax is deferred until the stock is sold, which allows for tax-free compounding of returns until sold. prefer a high dividend payout, since dividends received are not taxable to individual investors. d. be indifferent with regard to whether Apple issues dividends or repurchases its stock. None of the above. c. e. a. Darion Corporation currently has 200,000 shares of common stock outstanding at a market price of $40 per share. Which of the following statements is TRUE? If Darion has a 5-for-4 stock split, the share price should drop to $32. b. If Darion distributes a 25% stock dividend, the number of shares outstanding will increase to 250,000. If Darion has either a 5-for-4 stock split or a 25% stock dividend, the result on the share price and the number of shares outstanding will be identical. d. All of the above. None of the above. c. e. a. Which of the following is the CORRECT chronology of the dates connected with a cash dividend? declaration, record, ex-dividend, payment b. record, declaration, payment, ex-dividend declaration, record, payment, ex-dividend d. authorization, declaration, distribution, None of the above. c. e. a. Suppose you own one share of BMI common stock, priced at $20 per share right before the ex-dividend date. A dividend of $0.50/share had previously been declared, so you will receive $0.50 on the dividend payment date. Assuming you do not plan to sell BMI stock, what will happen to your total wealth from this investment on the morning of the ex-dividend date (measured in any form of asset, including cash, receivables, etc.)? Your total wealth will fall by $0.50 from the previous day's wealth. b. Your total wealth will fall by $20 to zero. Your total wealth will still be $20 but will now consist of a share of stock worth $19.50 and a dividend receivable worth $0.50, to be received on the payment date. d. Your total wealth will increase to $20.50, which equals the value of the stock plus the dividend. None of the above. c. e

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts