Question: please answer all questions posted #3-5 thanks Question 3 (1 point) In calculating the NPV for a cash flow stream, which is true? (Hint: if

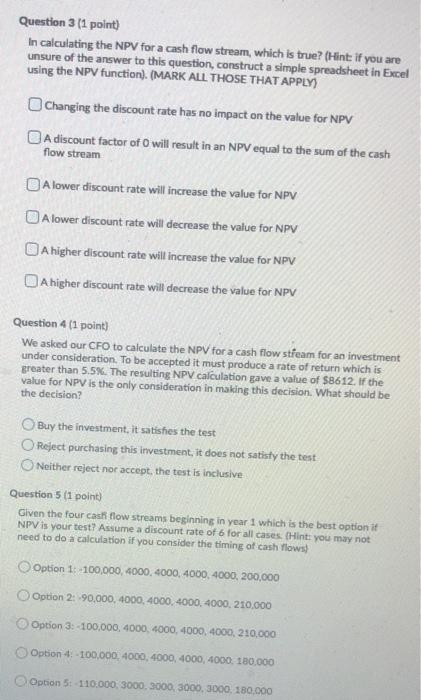

Question 3 (1 point) In calculating the NPV for a cash flow stream, which is true? (Hint: if you are unsure of the answer to this question, construct a simple spreadsheet in Excel using the NPV function). (MARK ALL THOSE THAT APPLY) Changing the discount rate has no impact on the value for NPV A discount factor of O will result in an NPV equal to the sum of the cash flow stream A lower discount rate will increase the value for NPV A lower discount rate will decrease the value for NPV A higher discount rate will increase the value for NPV A higher discount rate will decrease the value for NPV Question 4 (1 point) We asked our CFO to calculate the NPV for a cash flow stream for an investment under consideration. To be accepted it must produce a rate of return which is greater than 5.5%. The resulting NPV calculation gave a value of $8612. If the value for NPV is the only consideration in making this decision. What should be the decision? Buy the investment, it satisfies the test Reject purchasing this investment, it does not satisty the test Neither reject nor accept the test is inclusive Question 5 (1 point) Given the four cash flow streams beginning in year 1 which is the best option it NPV is your test? Assume a discount rate of 6 for all cases. (Hint: you may not need to do a calculation if you consider the timing of cash flows Option 1: -100,000, 4000, 4000, 4000, 4000, 200,000 Option 2: 90,000, 4000, 4000, 4000, 4000, 210,000 Option 3: -100,000, 4000, 4000, 4000, 4000, 210,000 Option 4: 100.000 4000, 4000, 4000, 4000, 180.000 Option 5: 110.000, 3000, 3000, 3000, 3000, 180,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts