Question: Please answer the following questions: Question 1 (1 point) If the pension plan needs to accumulate $1,400,000 million in 7 years, how much must it

Please answer the following questions:

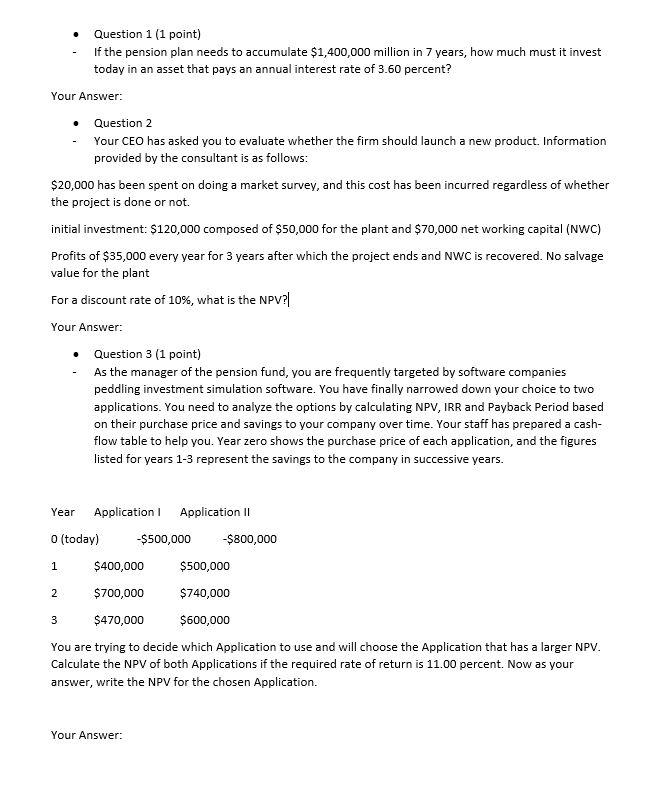

Question 1 (1 point) If the pension plan needs to accumulate $1,400,000 million in 7 years, how much must it invest today in an asset that pays an annual interest rate of 3.60 percent? Your Answer: Question 2 Your CEO has asked you to evaluate whether the firm should launch a new product. Information provided by the consultant is as follows: $20,000 has been spent on doing a market survey, and this cost has been incurred regardless of whether the project is done or not. initial investment: $120,000 composed of $50,000 for the plant and $70,000 net working capital (NWC) Profits of $35,000 every year for 3 years after which the project ends and NWC is recovered. No salvage value for the plant For a discount rate of 10%, what is the NPV?| Your Answer: Question 3 (1 point) As the manager of the pension fund, you are frequently targeted by software companies peddling investment simulation software. You have finally narrowed down your choice to two applications. You need to analyze the options by calculating NPV, IRR and Payback Period based on their purchase price and savings to your company over time. Your staff has prepared a cash- flow table to help you. Year zero shows the purchase price of each application, and the figures listed for years 1-3 represent the savings to the company in successive years. Application I Application II -$500,000 -$800,000 $400,000 $500,000 $700,000 $740,000 3 $470,000 $600,000 You are trying to decide which Application to use and will choose the Application that has a larger NPV. Calculate the NPV of both Applications if the required rate of return is 11.00 percent. Now as your answer, write the NPV for the chosen Application. Your Answer: Year 0 (today) 1 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts