Question: PLEASE ANSWER ALL QUESTIONS Q 3 . When JD bought the given portfolio she decided to hedge its value for one year in case the

PLEASE ANSWER ALL QUESTIONS

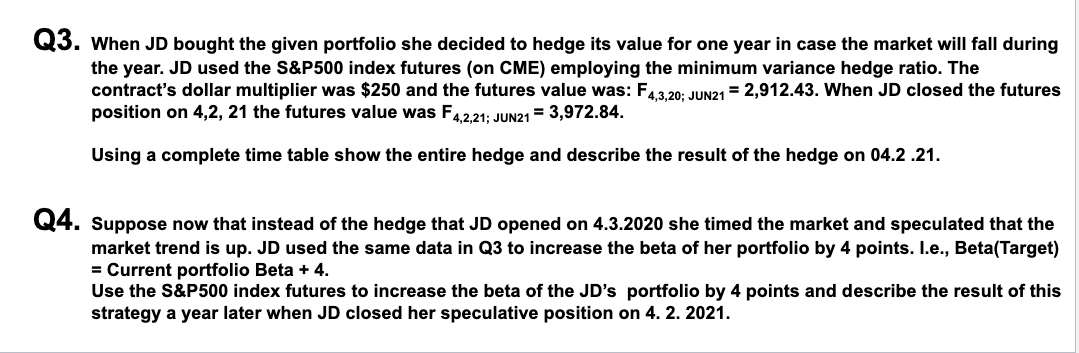

Q When JD bought the given portfolio she decided to hedge its value for one year in case the market will fall during the year. JD used the S&P index futures on CME employing the minimum variance hedge ratio. The contract's dollar multiplier was $ and the futures value was: F; JUN When JD closed the futures position on the futures value was F ; JUN

Using a complete time table show the entire hedge and describe the result of the hedge on

Q

Suppose now that instead of the hedge that JD opened on she timed the market and speculated that the market trend is up JD used the same data in Q to increase the beta of her portfolio by points. le BetaTarget Current portfolio Beta

Use the S&P index futures to increase the beta of the JDs portfolio by points and describe the result of this strategy a year later when JD closed her speculative position on

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock