Question: Please answer all questions Question 2 (1 point) Listen For 2021, Trey Shoemaker has Net Income for Tax Purposes of $460000 and Taxable income of

Please answer all questions

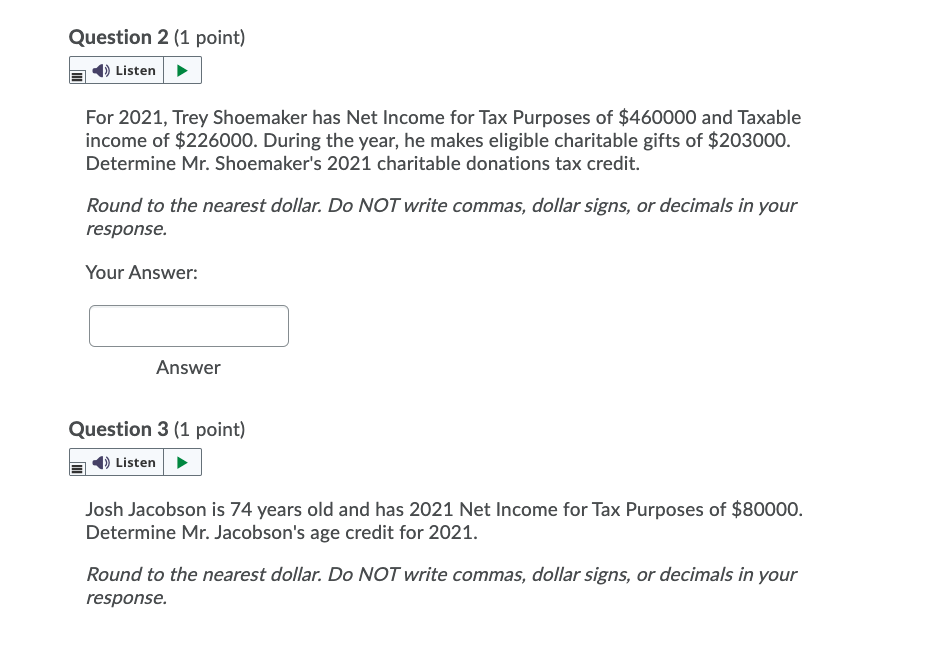

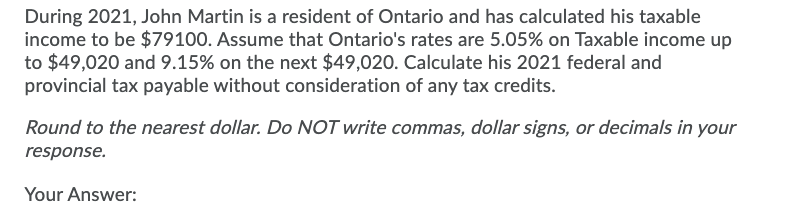

Question 2 (1 point) Listen For 2021, Trey Shoemaker has Net Income for Tax Purposes of $460000 and Taxable income of $226000. During the year, he makes eligible charitable gifts of $203000. Determine Mr. Shoemaker's 2021 charitable donations tax credit. Round to the nearest dollar. Do NOT write commas, dollar signs, or decimals in your response. Your Answer: Answer Question 3 (1 point) Listen Josh Jacobson is 74 years old and has 2021 Net Income for Tax Purposes of $80000. Determine Mr. Jacobson's age credit for 2021. Round to the nearest dollar. Do NOT write commas, dollar signs, or decimals in your response. During 2021, John Martin is a resident of Ontario and has calculated his taxable income to be $79100. Assume that Ontario's rates are 5.05% on Taxable income up to $49,020 and 9.15% on the next $49,020. Calculate his 2021 federal and provincial tax payable without consideration of any tax credits. Round to the nearest dollar. Do NOT write commas, dollar signs, or decimals in your response. Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts