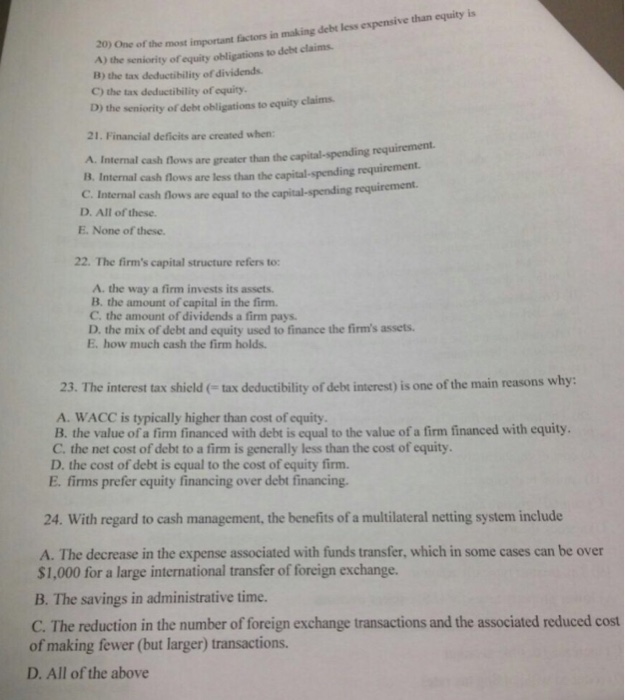

Question: Please answer all questions ve than equity is 20) One of y or B) the tax deductibility of dividends C) the tax deductibility of equity

ve than equity is 20) One of y or B) the tax deductibility of dividends C) the tax deductibility of equity D) the seniority of debt obligations to equity claims. 21. Financial deficits are created when requirement. A. Internal cash flows are greater than the capital-spending B. Internal cash fnows are less t C. Internal cash flows are equal to the capital-spending D. All of these. E. None of these. than the capital-spending requirement. requirement 22. The firm's capital structure refers to: A. the way a firm invests its assets. B. the amount of capital in the fim. C. the amount of dividends a firm pays. D. the mix of debt and equity used to finance the firm's assets. E. how much cash the firm holds 23. The interest tax shield (tax deductibility of debt interest) is one of the main reasons why: B. the value of a firm financed with debt is equal to the value of a firm financed with equity. A. WACC is typically higher than cost of equity. C. the net cost of debt to a firm is generally less than the cost of equity D. the cost of debt is equal to the cost of equity firm. E. firms prefer equity financing over debt financing 24. With regard to cash management, the benefits of a multilateral netting system include A. The decrease in the expense associated with funds transfer, which in some cases can be over $1,000 for a large international transfer of foreign exchange. B. The savings in administrative time. C. The reduction in the number of foreign exchange transactions and the associated reduced cost of making fewer (but larger) transactions. D. All of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts