Question: Please answer all. Thank you ! (20 points. Dividend Growth Model.) Silicon Mobile Inc. just paid a dividend of $3 per share (dividend at time

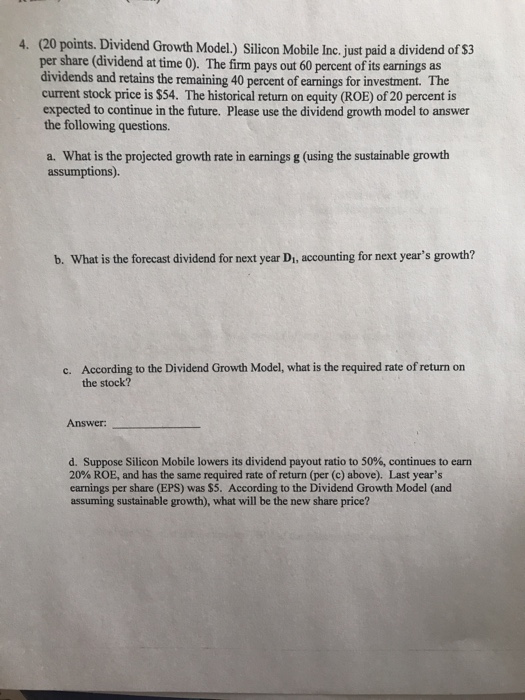

(20 points. Dividend Growth Model.) Silicon Mobile Inc. just paid a dividend of $3 per share (dividend at time 0). The firm pays out 60 percent of its earnings as dividends and retains the remaining 40 percent of earnings for investment. The current stock price is $54. The historical return on equity (ROE) of 20 percent is expected to continue in the future. Please use the dividend growth model to answer the following questions. 4. a. What is the projected growth rate in earnings g (using the sustainable growth assumptions). b. What is the forecast dividend for next year Di, accounting for next year's growth? According to the Dividend Growth Model, what is the required rate of return on the stock? c. Answer: d. Suppose Silicon Mobile lowers its dividend payout ratio to 50%, continues to earn 20% ROE, and has the same required rate of return (per (c) above). Last year's earnings per share (EPS) was $5. According to the Dividend Growth Model (and assuming sustainable growth), what will be the new share price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts