Question: PLEASE ANSWER ALL THANK YOU! Question 1 (22 marks) You are evaluating the performance of two portfolio managers and you have gathered annual return data

PLEASE ANSWER ALL THANK YOU!

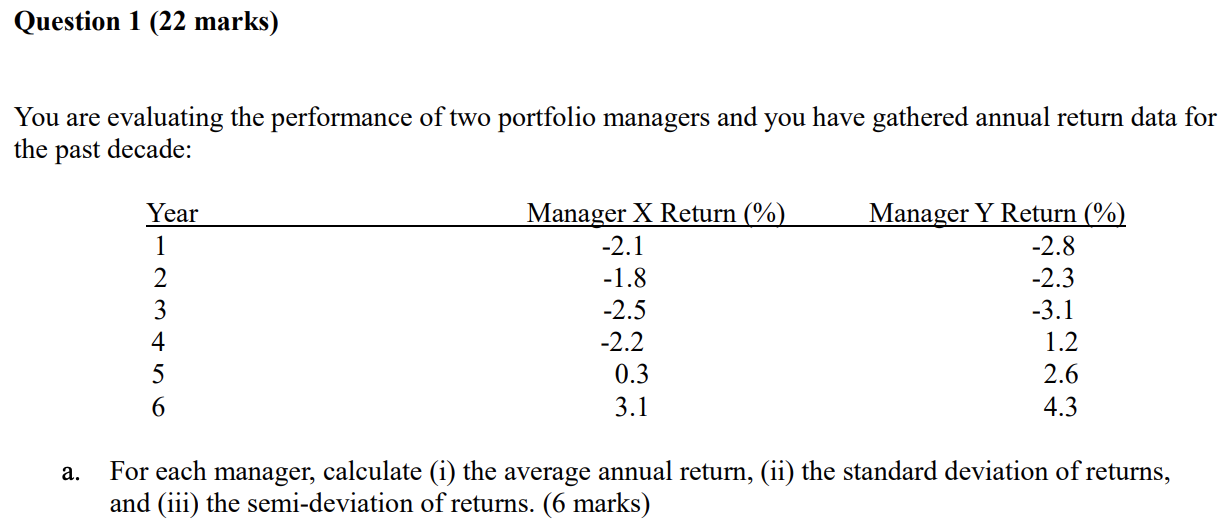

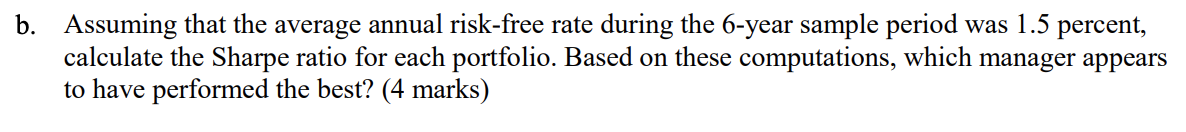

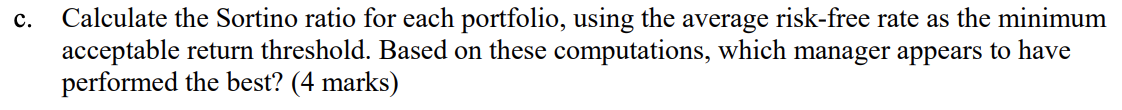

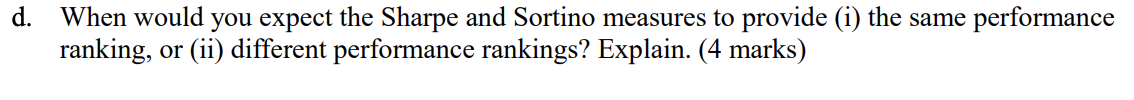

Question 1 (22 marks) You are evaluating the performance of two portfolio managers and you have gathered annual return data for the past decade: Year 1 2 3 4 5 6 Manager X Return (%) -2.1 -1.8 -2.5 -2.2 0.3 3.1 Manager Y Return (%) -2.8 -2.3 -3.1 1.2 2.6 4.3 a. For each manager, calculate (i) the average annual return, (ii) the standard deviation of returns, and (iii) the semi-deviation of returns. (6 marks) b. Assuming that the average annual risk-free rate during the 6-year sample period was 1.5 percent, calculate the Sharpe ratio for each portfolio. Based on these computations, which manager appears to have performed the best? (4 marks) c. Calculate the Sortino ratio for each portfolio, using the average risk-free rate as the minimum acceptable return threshold. Based on these computations, which manager appears to have performed the best? (4 marks) d. When would you expect the Sharpe and Sortino measures to provide (i) the same performance ranking, or (ii) different performance rankings? Explain. (4 marks) e. Under what circumstances should investor use the Sharpe or Treynor ratios as a measure of performance of their portfolio, and why? (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts