Question: Please answer all the problems!! Thank you so much!! Exercise 10-21 (Algo) Amortization of intangible assets LO P4 Milano Gallery purchases the copyright on a

Please answer all the problems!! Thank you so much!!

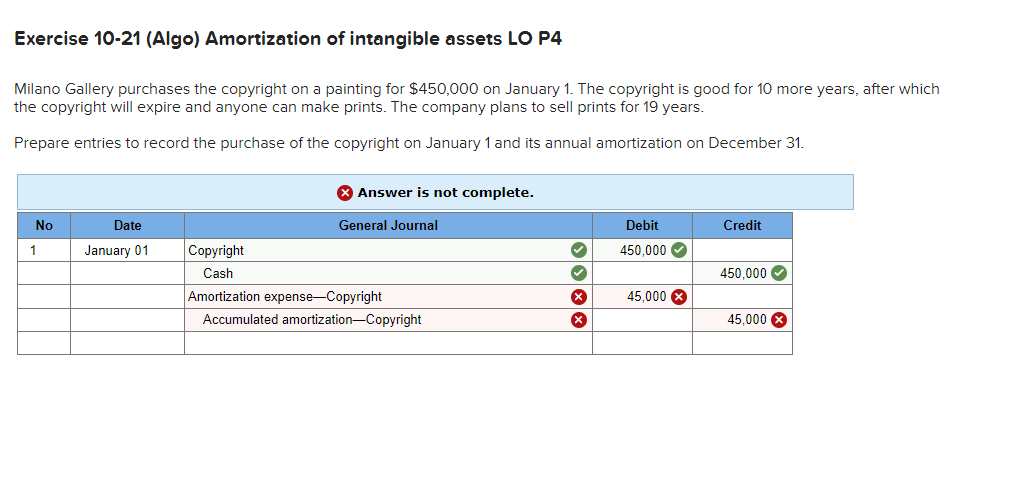

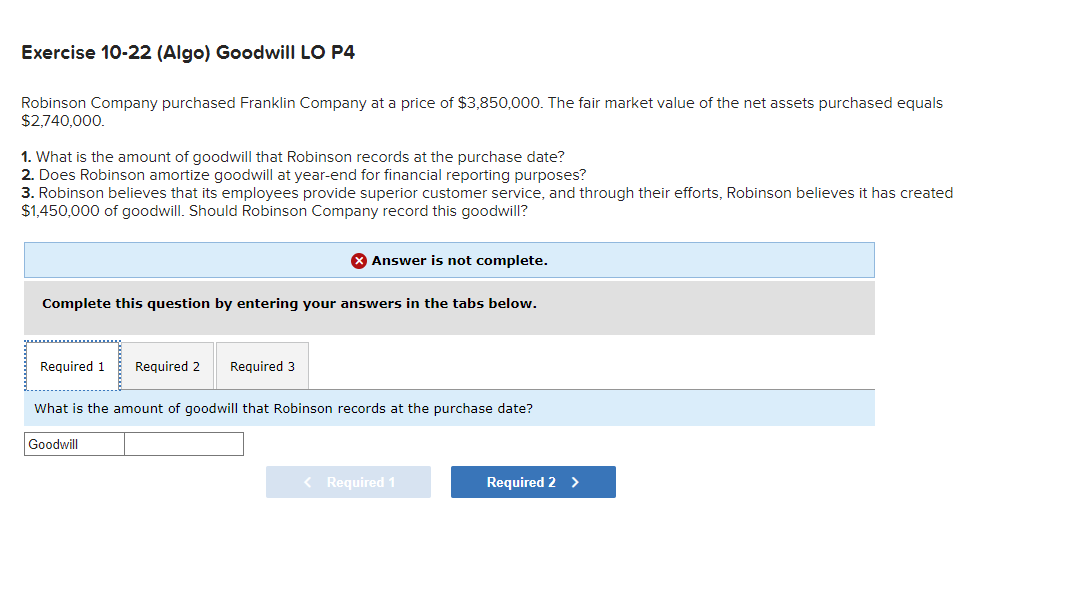

Exercise 10-21 (Algo) Amortization of intangible assets LO P4 Milano Gallery purchases the copyright on a painting for $450,000 on January 1 . The copyright is good for 10 more years, after which the copyright will expire and anyone can make prints. The company plans to sell prints for 19 years. Prepare entries to record the purchase of the copyright on January 1 and its annual amortization on December 31. Robinson Company purchased Franklin Company at a price of $3,850,000. The fair market value of the net assets purchased equals $2,740,000 1. What is the amount of goodwill that Robinson records at the purchase date? 2. Does Robinson amortize goodwill at year-end for financial reporting purposes? 3. Robinson believes that its employees provide superior customer service, and through their efforts, Robinson believes it has createc $1,450,000 of goodwill. Should Robinson Company record this goodwill? x Answer is not complete. Complete this question by entering your answers in the tabs below. What is the amount of goodwill that Robinson records at the purchase date

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts