Question: PLEASE ANSWER ALL THE QUESTIONS AND LABEL THEM WITH THE CORRESPONDING LETTER 5 an option trader, you are constantly looking for opportunities to make an

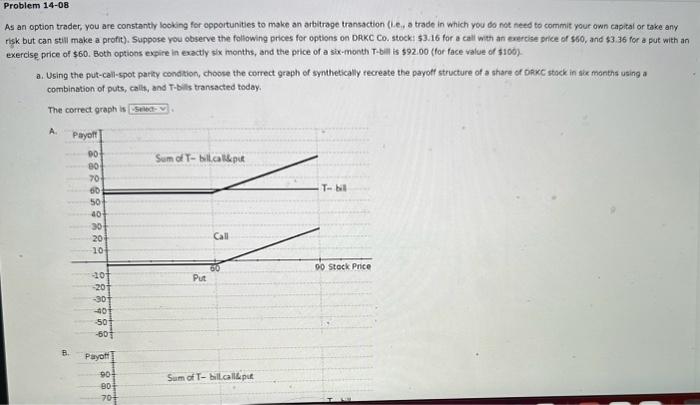

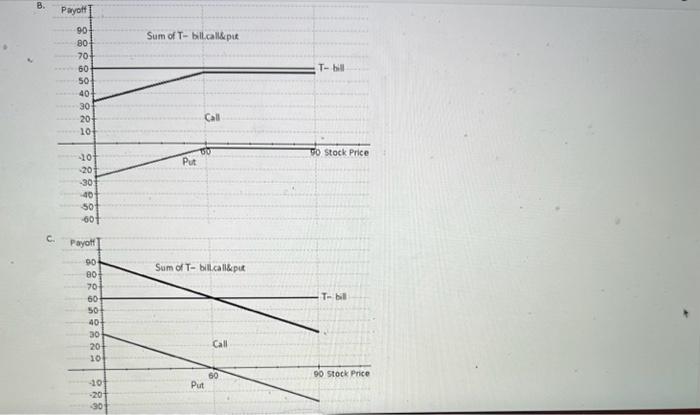

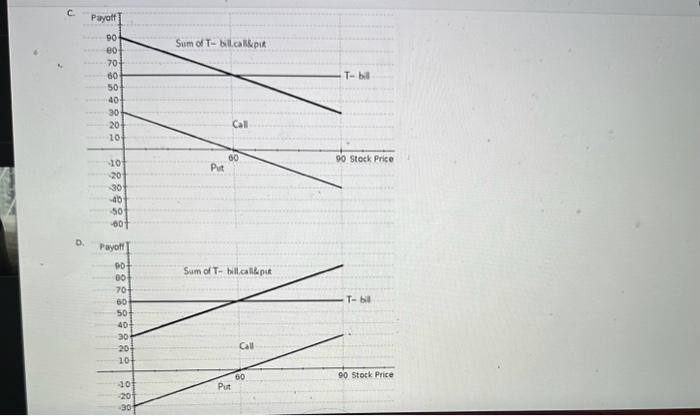

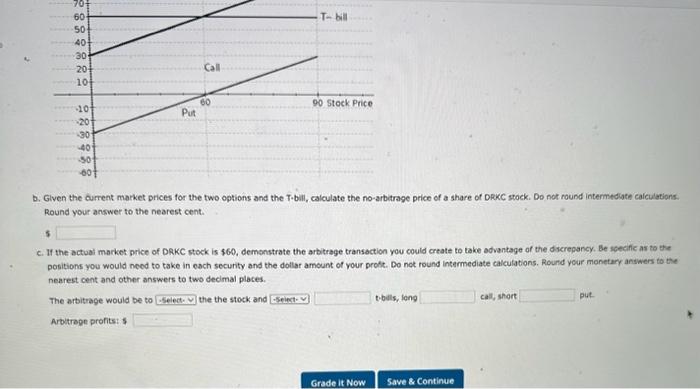

5 an option trader, you are constantly looking for opportunities to make an arbitrage transsction (Le., s trade in which you do not feed to commit your own capital or take any k but can still make a profit). Suppose you observe the following prices for options on DRKC Co. stocki 53.16 for a call with an trercise price of s50, and $3.36 for a put with an xercise, price of $60. Both options expire in exactly six months, and the price of a six-month T-bill is $92.00 (for face walue of $100). a. Using the put-call-spot parily condition, choose the correct greph of synthetically recreate the payoff structure of a share of bakce stock in sik months using a combination of puts, call, and T-bils transacted today. The correct graph is B. c. c. D. b. Glven the current market prices for the two options and the Trbili, calculate the no-arbetrage price of a share of Dekc stock. Do not round intermediate calculations. Round your answer to the nearest cent: 5 c. If the actual market arice of DRKC steck is $60, demonstrate the arbitrage transaction you could crtate to take advantage of the discregancy, Be sgecific as to the positions you would need to take in each security and the dollar amount of your proft. Do not round intermediate calculations. Round your monetary answers to the nearest cent and other answers to two decimal places. The arbitrage would be to the the stock and Arbitrege profits: 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts