Question: Please answer all the questions Using ratios to evaluate a share investment The comparative financial statement data of Danfield Ltd follows Additional Information 1. Market

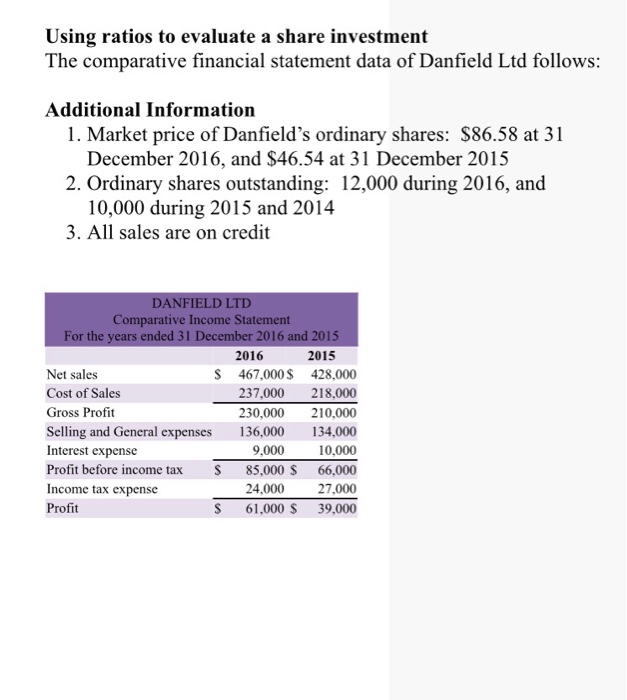

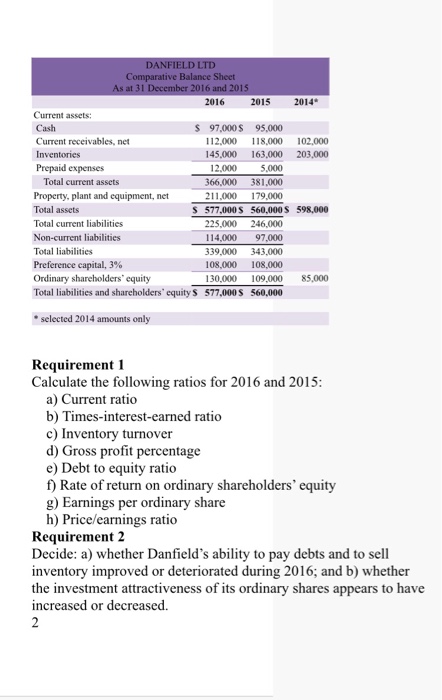

Using ratios to evaluate a share investment The comparative financial statement data of Danfield Ltd follows Additional Information 1. Market price of Danfield's ordinary shares: $86.58 at 31 December 2016, and $46.54 at 31 December 2015 2. Ordinary shares outstanding: 12,000 during 2016, and 10,000 during 2015 and 2014 3. All sales are on credit DANFIE Comparative Income Statement For the years ended 3 cember 2016 and 2015 2015 2016 Net sales Cost of Sales Gross Profit S 467,000 428,000 237,000 218.,000 230,000 210,000 Selling and General expenses 136,000 134,000 0,000 Profit before income tax 85,000 S 66,000 27,000 S 61,000 39,000 Interest expense 9,000 Income tax expense Profit 24,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts