Question: Please answer all these three questions. Here is some data from the WSJ for a regular Treasury Note observed on November 15, 2019. The accrued

Please answer all these three questions.

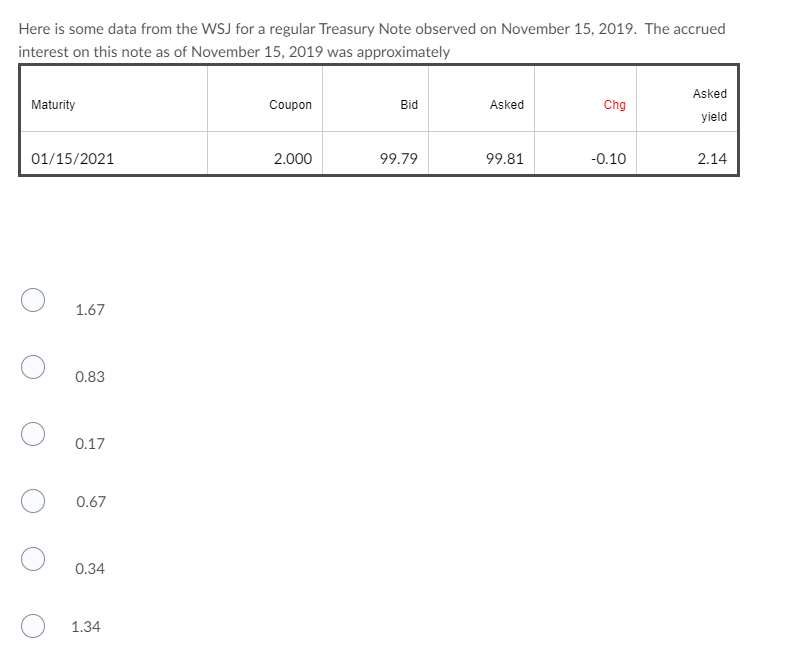

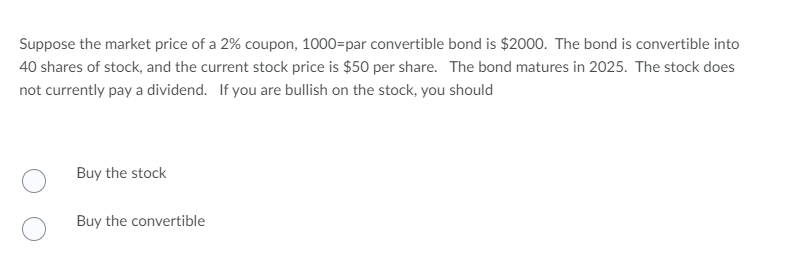

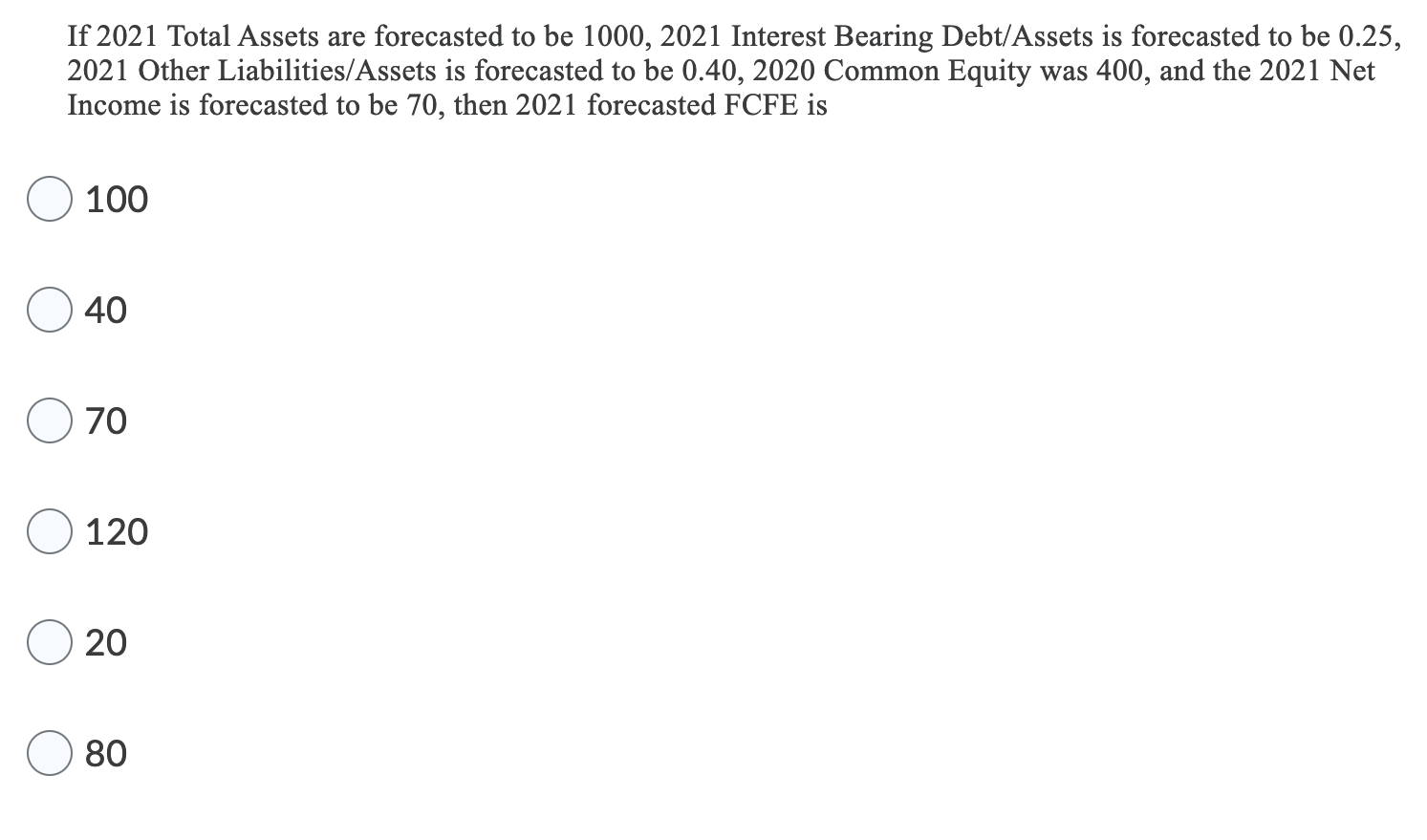

Here is some data from the WSJ for a regular Treasury Note observed on November 15, 2019. The accrued interest on this note as of November 15, 2019 was approximately Maturity Coupon Bid Asked Chg Asked yield 01/15/2021 2.000 99.79 99.81 -0.10 2.14 1.67 0.83 0.17 0.67 0.34 1.34 Suppose the market price of a 2% coupon, 1000=par convertible bond is $2000. The bond is convertible into 40 shares of stock, and the current stock price is $50 per share. The bond matures in 2025. The stock does not currently pay a dividend. If you are bullish on the stock, you should Buy the stock Buy the convertible If 2021 Total Assets are forecasted to be 1000, 2021 Interest Bearing Debt/Assets is forecasted to be 0.25, 2021 Other Liabilities/Assets is forecasted to be 0.40, 2020 Common Equity was 400, and the 2021 Net Income is forecasted to be 70, then 2021 forecasted FCFE is 100 40 70 120 20 80

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts