Question: please answer and explain 23. The following net cash flows are projected for two separate projects. Your required rate ofretum is 12%. Year Proiect A

please answer and explain

please answer and explain

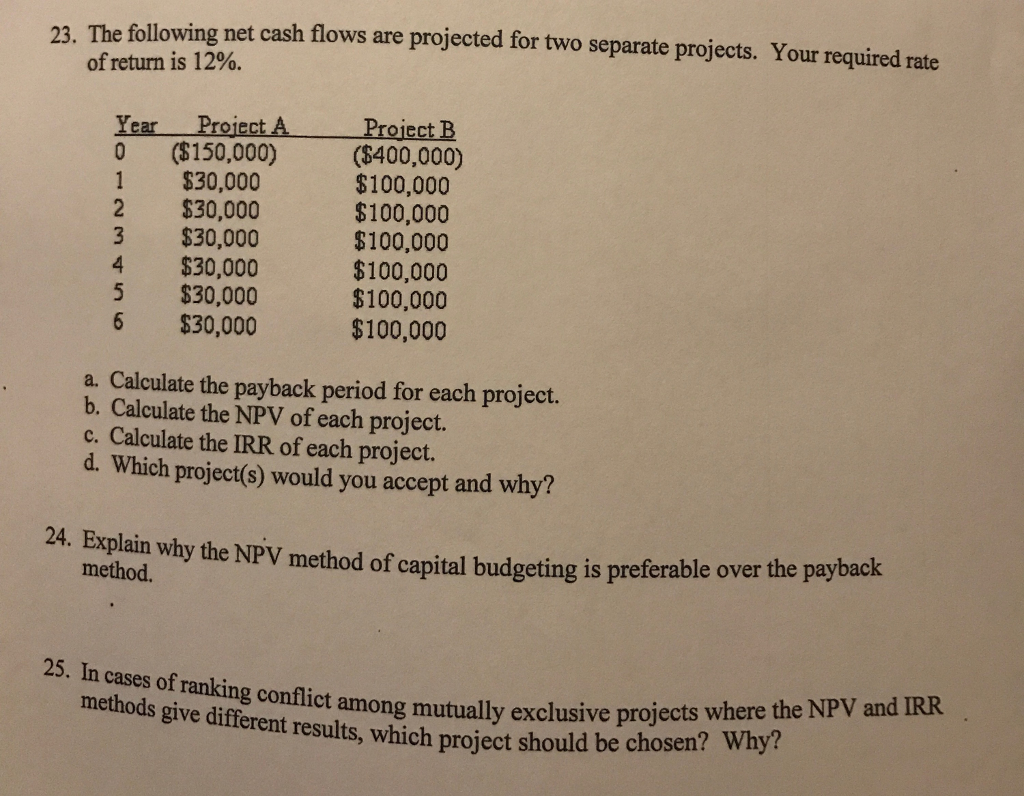

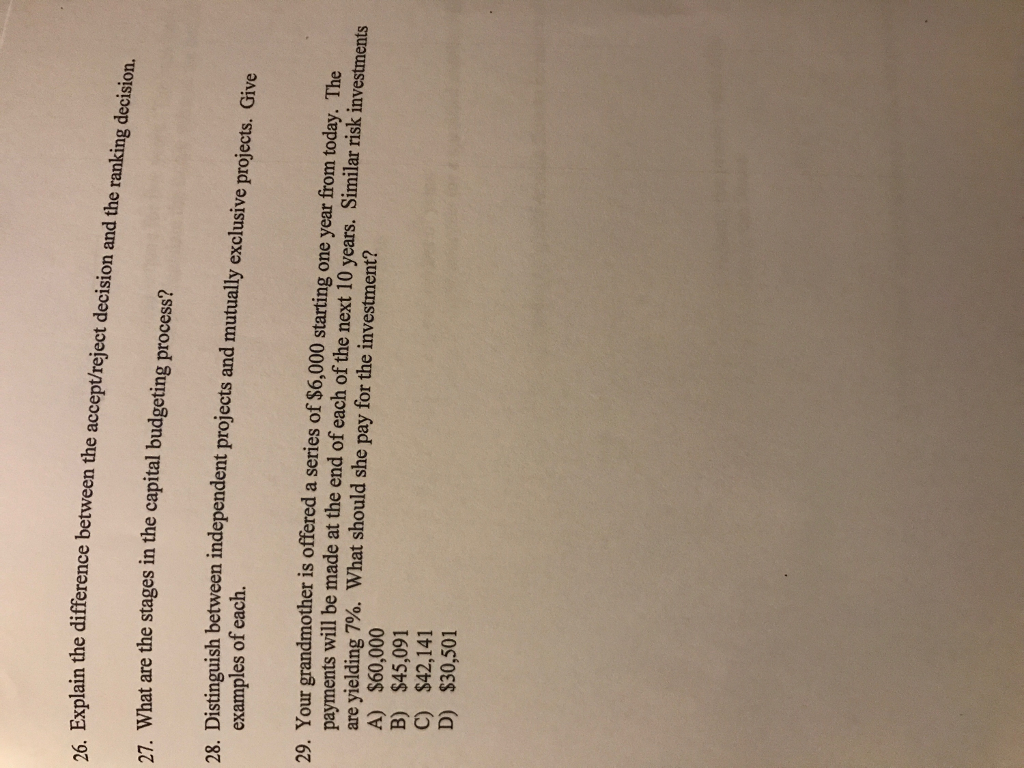

23. The following net cash flows are projected for two separate projects. Your required rate ofretum is 12%. Year Proiect A Project B 0 (150,000) (400,000) 1 $30,000 2 $30,000 3 $30,000 4 $30,000 5 $30,000 6 $30,000 $100,000 $100,000 $100,000 $100,000 $100,000 $100,000 a. Calculate the payback period for each project. b. Calculate the NPV of each project c. Calculate the IRR of each project. d. Which project(s) would you accept and why? 24. Explain why the NPV method of capital budgeting is preferable over the payback method. 25. In cases of ranking conflict give dimerco among mutually exclusive projects where the NPV and IRR mutu chosen? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts