Question: Please answer and show excel formulas. I will surely give a like. Thank you. In Excel, create a solution with all of the following items.

Please answer and show excel formulas. I will surely give a like. Thank you.

In Excel, create a solution with all of the following items. (please show formulas)

a. Cost of Goods Sold budget

b. Budgeted Income Statement

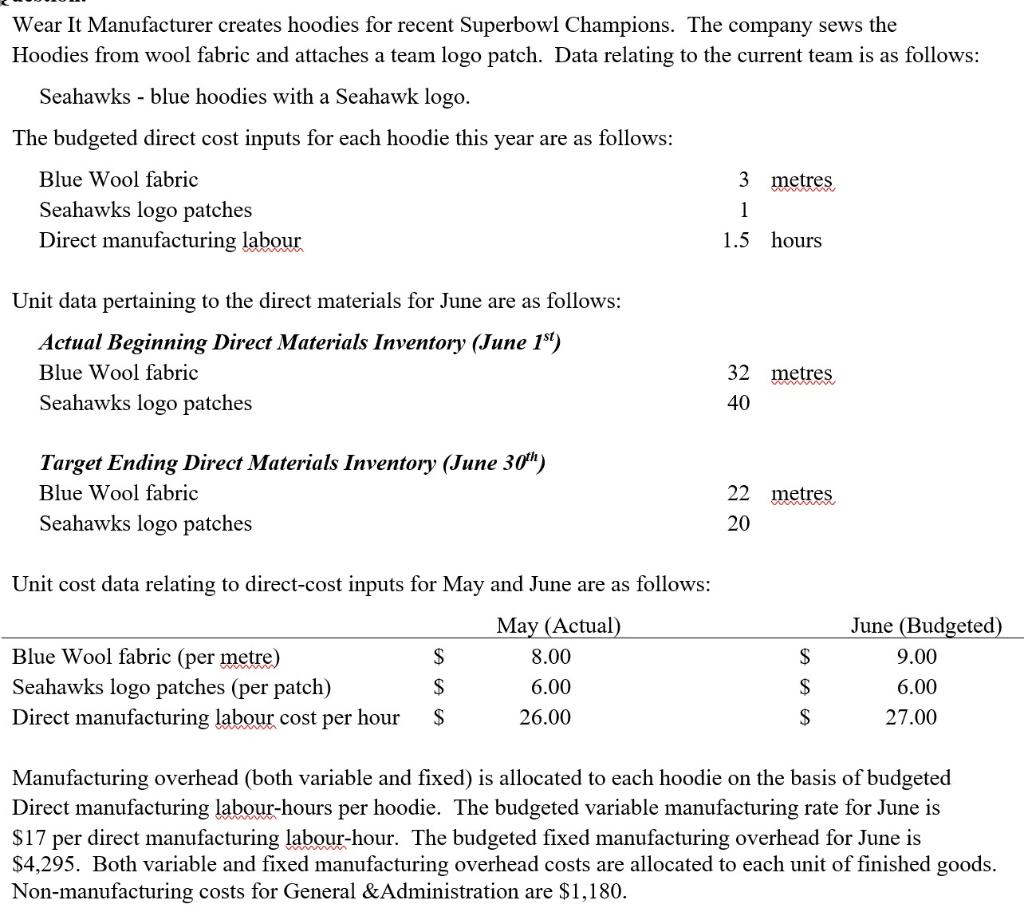

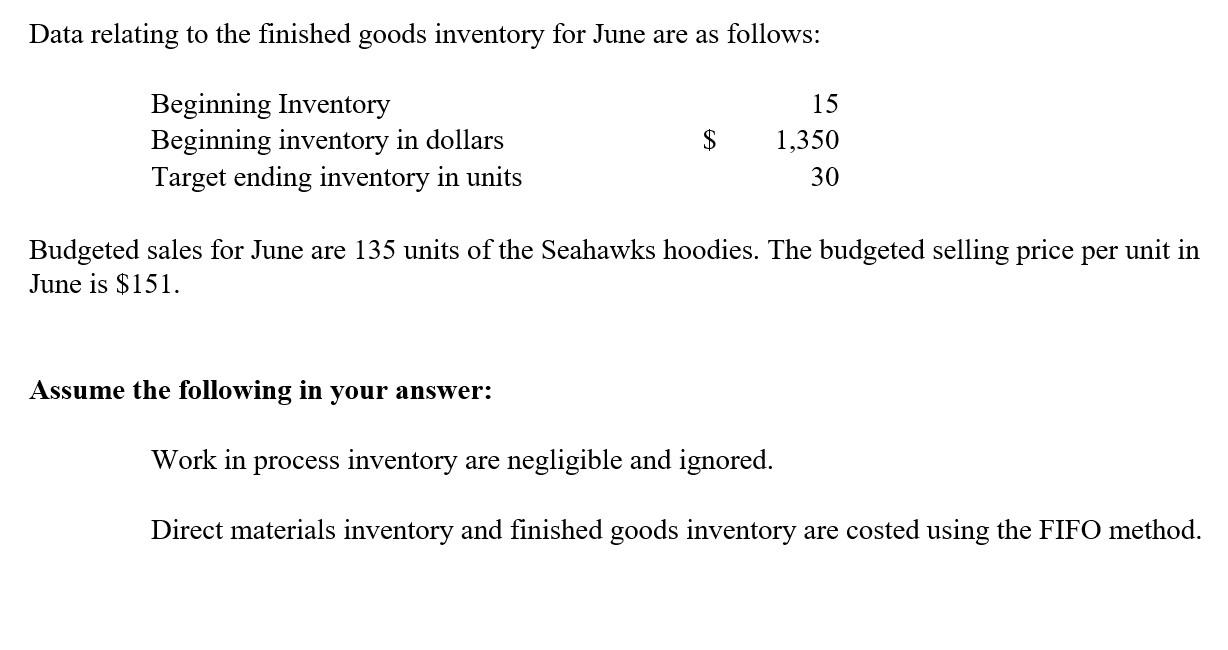

Unit cost data relating to direct-cost inputs for May and June are as follows: Manufacturing overhead (both variable and fixed) is allocated to each hoodie on the basis of budgeted Direct manufacturing labour-hours per hoodie. The budgeted variable manufacturing rate for June is $17 per direct manufacturing labour-hour. The budgeted fixed manufacturing overhead for June is $4,295. Both variable and fixed manufacturing overhead costs are allocated to each unit of finished goods. Non-manufacturing costs for General \&Administration are $1,180. Data relating to the finished goods inventory for June are as follows: Budgeted sales for June are 135 units of the Seahawks hoodies. The budgeted selling price per unit in June is $151. Assume the following in your answer: Work in process inventory are negligible and ignored. Direct materials inventory and finished goods inventory are costed using the FIFO method. Unit cost data relating to direct-cost inputs for May and June are as follows: Manufacturing overhead (both variable and fixed) is allocated to each hoodie on the basis of budgeted Direct manufacturing labour-hours per hoodie. The budgeted variable manufacturing rate for June is $17 per direct manufacturing labour-hour. The budgeted fixed manufacturing overhead for June is $4,295. Both variable and fixed manufacturing overhead costs are allocated to each unit of finished goods. Non-manufacturing costs for General \&Administration are $1,180. Data relating to the finished goods inventory for June are as follows: Budgeted sales for June are 135 units of the Seahawks hoodies. The budgeted selling price per unit in June is $151. Assume the following in your answer: Work in process inventory are negligible and ignored. Direct materials inventory and finished goods inventory are costed using the FIFO method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts