Question: please answer as soon as possible Case study Learning Objectives The purpose of this case is to help you: Students will possess knowledge of current

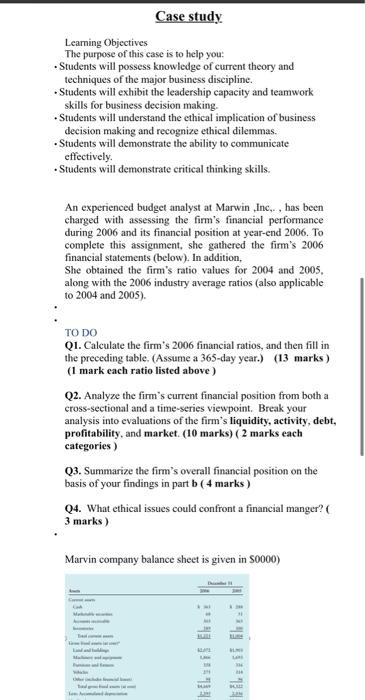

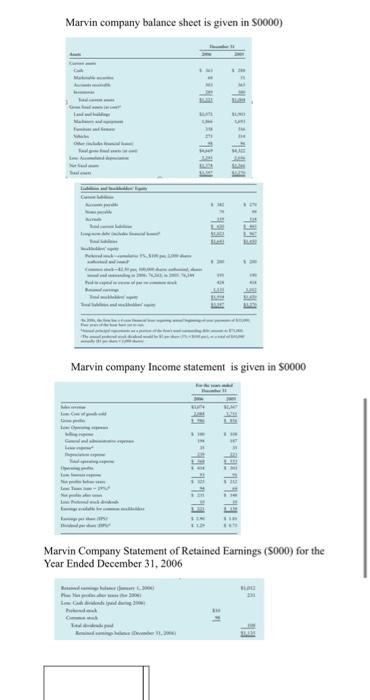

Case study Learning Objectives The purpose of this case is to help you: Students will possess knowledge of current theory and techniques of the major business discipline. Students will exhibit the leadership capacity and teamwork skills for business decision making. Students will understand the ethical implication of business decision making and recognize ethical dilemmas. Students will demonstrate the ability to communicate effectively. Students will demonstrate critical thinking skills. An experienced budget analyst at Marwin, Inc., has been charged with assessing the firm's financial performance during 2006 and its financial position at year-end 2006. To complete this assignment, she gathered the firm's 2006 financial statements (below). In addition, She obtained the firm's ratio values for 2004 and 2005. along with the 2006 industry average ratios (also applicable to 2004 and 2005). TO DO Q1. Calculate the firm's 2006 financial ratios, and then fill in the preceding table. (Assume a 365-day year.) (13 marks) (1 mark each ratio listed above) Q2. Analyze the firm's current financial position from both a cross-sectional and a time-series viewpoint. Break your analysis into evaluations of the firm's liquidity, activity, debt, profitability, and market. (10 marks) (2 marks each categories ) Q3. Summarize the firm's overall financial position on the basis of your findings in part b ( 4 marks) Q4. What ethical issues could confront a financial manger? 3 marks) Marvin company balance sheet is given in S0000) Marvin company balance sheet is given in S0000) Law NO ENELE Ellis i ERC Marvin company Income statement is given in 80000 BIELL S 1932 1931 1930 | Marvin Company Statement of Retained Earnings (5000) for the Year Ended December 31, 2006 Case study Learning Objectives The purpose of this case is to help you: Students will possess knowledge of current theory and techniques of the major business discipline. Students will exhibit the leadership capacity and teamwork skills for business decision making. Students will understand the ethical implication of business decision making and recognize ethical dilemmas. Students will demonstrate the ability to communicate effectively. Students will demonstrate critical thinking skills. An experienced budget analyst at Marwin, Inc., has been charged with assessing the firm's financial performance during 2006 and its financial position at year-end 2006. To complete this assignment, she gathered the firm's 2006 financial statements (below). In addition, She obtained the firm's ratio values for 2004 and 2005. along with the 2006 industry average ratios (also applicable to 2004 and 2005). TO DO Q1. Calculate the firm's 2006 financial ratios, and then fill in the preceding table. (Assume a 365-day year.) (13 marks) (1 mark each ratio listed above) Q2. Analyze the firm's current financial position from both a cross-sectional and a time-series viewpoint. Break your analysis into evaluations of the firm's liquidity, activity, debt, profitability, and market. (10 marks) (2 marks each categories ) Q3. Summarize the firm's overall financial position on the basis of your findings in part b ( 4 marks) Q4. What ethical issues could confront a financial manger? 3 marks) Marvin company balance sheet is given in S0000) Marvin company balance sheet is given in S0000) Law NO ENELE Ellis i ERC Marvin company Income statement is given in 80000 BIELL S 1932 1931 1930 | Marvin Company Statement of Retained Earnings (5000) for the Year Ended December 31, 2006

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts