Question: Please answer as soon as possible. I need it very soon. Question 2 Potter plc is a diversified firm with 3 divisions in operations i.e.

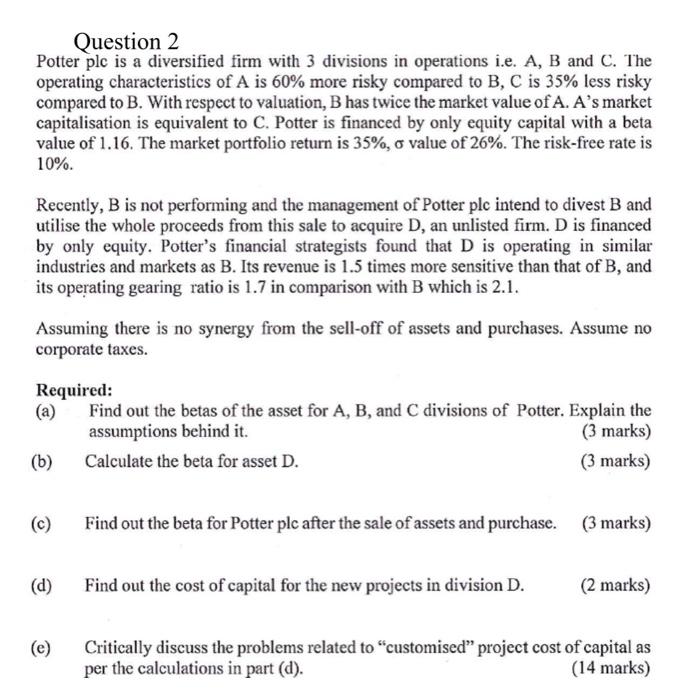

Question 2 Potter plc is a diversified firm with 3 divisions in operations i.e. A,B and C. The operating characteristics of A is 60% more risky compared to B,C is 35% less risky compared to B. With respect to valuation, B has twice the market value of A. A's market capitalisation is equivalent to C. Potter is financed by only equity capital with a beta value of 1.16. The market portfolio return is 35%, value of 26%. The risk-free rate is 10%. Recently, B is not performing and the management of Potter ple intend to divest B and utilise the whole proceeds from this sale to acquire D, an unlisted firm. D is financed by only equity. Potter's financial strategists found that D is operating in similar industries and markets as B. Its revenue is 1.5 times more sensitive than that of B, and its operating gearing ratio is 1.7 in comparison with B which is 2.1. Assuming there is no synergy from the sell-off of assets and purchases. Assume no corporate taxes. Required: (a) Find out the betas of the asset for A, B, and C divisions of Potter. Explain the assumptions behind it. (3 marks) (b) Calculate the beta for asset D. (3 marks) (c) Find out the beta for Potter plc after the sale of assets and purchase. (3 marks) (d) Find out the cost of capital for the new projects in division D. (2 marks) (e) Critically discuss the problems related to "customised" project cost of capital as per the calculations in part (d). (14 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts