Question: please answer as soon as possible it my exam please answer quickly PART 3. RATE OF RETURN The table shows the return on assets X

please answer as soon as possible it my exam please answer quickly

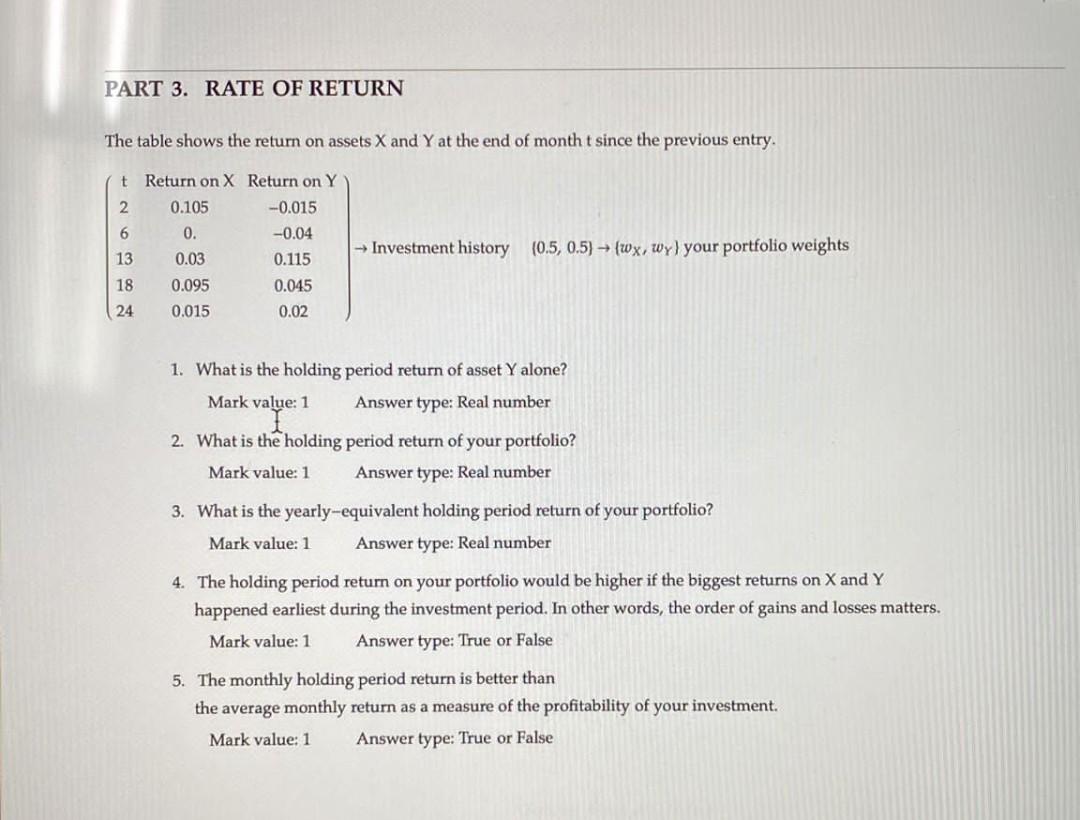

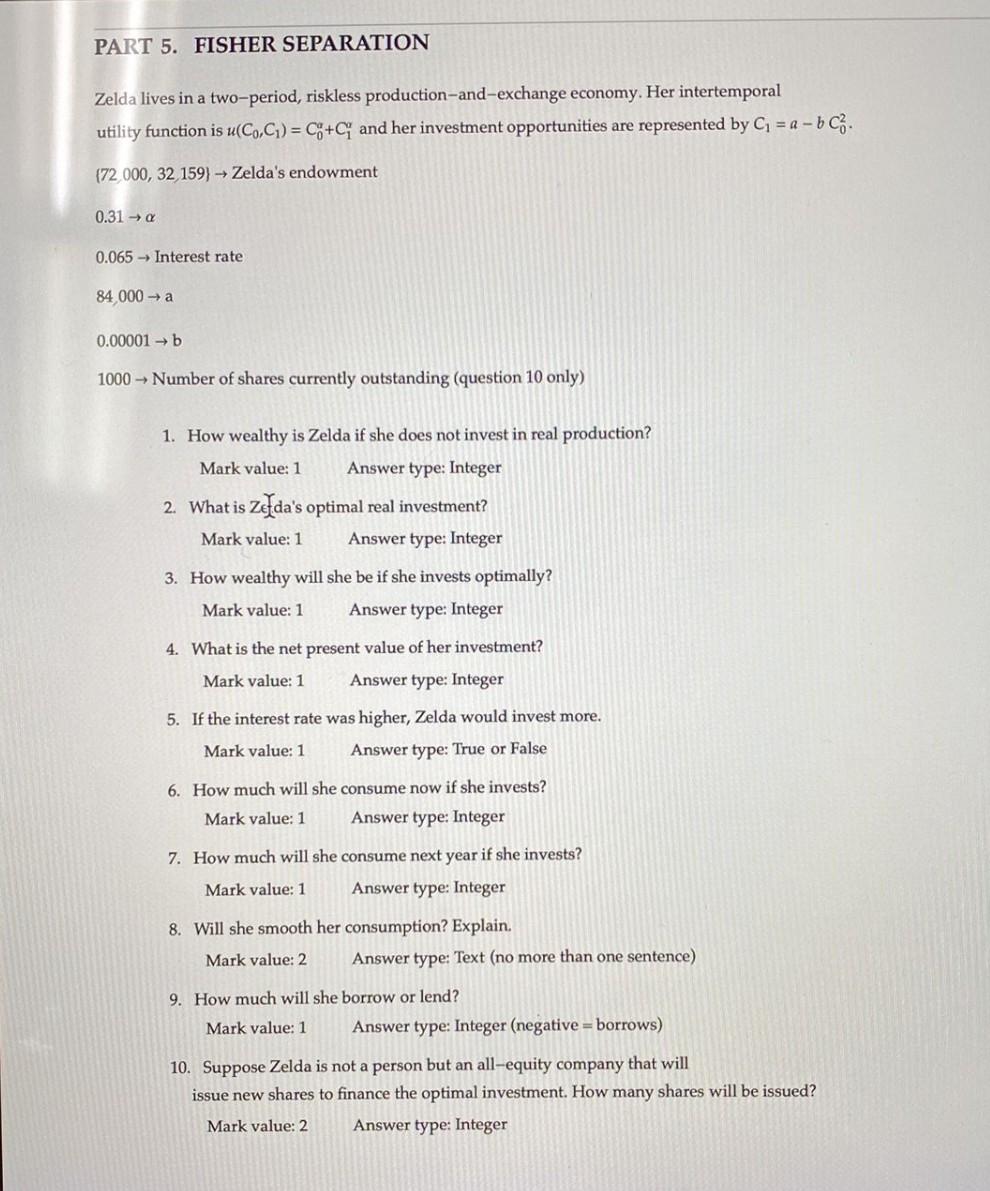

PART 3. RATE OF RETURN The table shows the return on assets X and Y at the end of month t since the previous entry. t 2 6 Return on X Return on Y 0.105 -0.015 0. -0.04 0.03 0.115 0.095 0.045 0.015 0.02 - Investment history (0.5, 0.5) (wx, wy) your portfolio weights 13 18 24 1. What is the holding period return of asset Y alone? Mark value: 1 Answer type: Real number 2. What is the holding period return of your portfolio? Mark value: 1 Answer type: Real number 3. What is the yearly-equivalent holding period return of your portfolio? Mark value: 1 Answer type: Real number 4. The holding period return on your portfolio would be higher if the biggest returns on X and Y happened earliest during the investment period. In other words, the order of gains and losses matters. Mark value: 1 Answer type: True or False 5. The monthly holding period return is better than the average monthly return as a measure of the profitability of your investment. Mark value: 1 Answer type: True or False PART 5. FISHER SEPARATION Zelda lives in a two-period, riskless production-and-exchange economy. Her intertemporal utility function is u(Co,C) = C+C and her investment opportunities are represented by C = a - b Cz. {72 000, 32 159) Zelda's endowment 0.31 a 0.065 - Interest rate 84.000 0.00001 1000 Number of shares currently outstanding (question 10 only) 1. How wealthy is Zelda if she does not invest in real production? Mark value: 1 Answer type: Integer 2. What is zeda's optimal real investment? Mark value: 1 Answer type: Integer 3. How wealthy will she be if she invests optimally? Mark value: 1 Answer type: Integer 4. What is the net present value of her investment? Mark value: 1 Answer type: Integer 5. If the interest rate was higher, Zelda would invest more. Mark value: 1 Answer type: True or False 6. How much will she consume now if she invests? Mark value: 1 Answer type: Integer 7. How much will she consume next year if she invests? Mark value: 1 Answer type: Integer 8. Will she smooth her consumption? Explain. Mark value: 2 Answer type: Text (no more than one sentence) 9. How much will she borrow or lend? Mark value: 1 Answer type: Integer (negative = borrows) 10. Suppose Zelda is not a person but an all-equity company that will issue new shares to finance the optimal investment. How many shares will be issued? Mark value: 2 Answer type: Integer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts